Understanding Transaction Success Rate (TSR)

The cashless economy is driven by digital payments, fuelled by the rapid advancement in the FinTech sector. One of the most essential tools of digital payments used today is the Payment Gateway. It enables businesses to accept and process seamless financial transactions. Although there are several metrics to measure the efficiency of a Payment Gateway, Transaction Success Rate (TSR) is one of the chief metrics to assess and quantify the competence of a Payment Gateway. Understanding Transaction Success Rate of Payment Gateway is key to making the right choice.

What is Transaction Success Rate?

In a digitized business, when the customer clicks ‘Buy Now’ and the site or app takes him to the payments page with several different payment modes and offers. The customer then clicks on one of the payment modes and proceeds to pay for the purchase. Ideally, the Payment Gateway should process the transaction with ease and send the ‘payment transaction success’ status to the customer. Due to several reasons, the transaction might be a failure triggering a refund or non-acceptance of payment.

The Transaction Success Rate refers to the percentage of attempted payments that ended with successful payments transfer. It is calculated using the formula in the image given below. In simple terms, if a customer attempted 100 different purchases on a specific website or app, and the payment transaction was successfully processed 97 out of the 100 times, then the payment success rate of the Payment Gateway is 97%.

How is TSR important?

Transaction Success Rate is a metric to measure the efficiency of Payment Gateway. Here are the reasons for why the efficiency metric of a Payment Gateway matters to an online business. According to Statista, the total transaction value in the Digital Payments Segment of India is projected to reach $133.40bn in 2022.

The unprecedented growth is due to increased internet penetration and the innovations in mobile payment technology. The default payment modes like credit/debit card are sparsely used these days, as UPI (Unified Payments Interface), Wallets, and more innovative Payment Modes are popular in the digital payment sectors. Transaction Success Rate (TSR) is one of the metrics that allow the vendor or business owner to quantify the efficiency of a Payment Gateway.

Why should Transaction Success Rate matter to a business?

To understand the importance of TSR, every business owner or business stakeholders need to know the key elements of revenue generation and customer retention.

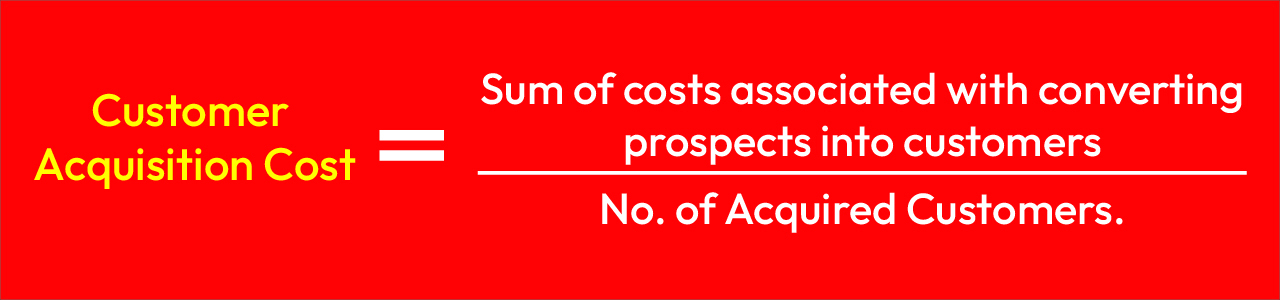

- Customer Acquisition Cost- The cost sustained by a business to acquire and onboard a new customer. It is the summation of costs associated with converting prospects into customers (marketing, advertising, sales personnel, and more) and dividing the amount by no. of acquired customers.

- Churn Rate - Also, referred to as the rate of attrition or customer churn is the rate at which customers stop doing business with an entity.

.jpg)

When processing digital payments, the payment transaction failure leads to higher customer attrition i.e., increased churn rate. This translates to higher Customer Retention Cost that the business needs to invest for reducing the churn rate. The one metric that ensures both key elements are on the positive side of the scale is the Transaction Success Rate. Hence, choosing a Payment Gateway with higher TSR is crucial for customer satisfaction and retention.

When does ‘Transaction Success Rate’ drop?

Now, that we know how TSR impacts a business. It is equally important to understand the several factors that affect the Transaction Success Rate. According to some of the leading Payment Gateways in India, the chief factor that affects TSR are the customers themselves, deliberately cancelling a payment. The other major impacting factor are the issues associated with the Payment Ecosystem- Payments Providers & other intermediaries. Using Multiple Payment Gateways coupled with a strong UI/UX design reduces the impact on TSR.

Choosing the right Payment Gateway with high TSR is vital to a business. It impacts the overall business- customer acquisition cost, customer retention cost, churn rate and revenue generation. We at Pay10 offer innovative, ultra-proficient, and multifaceted FinTech services empowering your business with easy, reliable, and secure digital payments.