UPI Transaction mistake? Follow the simple 4-step process to retrieve your money.

Unified Payments Interface (UPI), the popular choice of millions for making a merchant payment or transferring cash. The meteoric rise to ubiquity in a country as diverse and dynamic as India makes it a resounding success story, worldwide. UPI enables quick and convenient real-time digital payment that allows users to transfer money directly from one bank account to another: from customer to merchant/business or peer-to-peer i.e., between individuals.

The UPI payment system appears straightforward and the architecture supporting the system is largely based on the secure legacy systems of traditional banking but integrated with a modern technological innovation. The elevated level of interoperability is the unique selling point of the fast, flexible, and convenient real-time digital payment system of UPI. Since, UPI implementation in 2016, the payment system has undergone significant improvements to tackle the security risks upon implementation at population scale.

NPCI’s UPI Dispute Redressal Mechanism

Consumer Payment Information is highly sensitive to be shared with a third-party. So, how does OpenUPI transactions are simple, hassle-free, and convenient when compared to other payment processes. Although the ‘click and pay’ digital payment system is easy to use which makes human error understandably a part of the process, just like any other system. NPCI (National Payments Corporation of India) has introduced UPI Dispute Redressal Mechanism that helps to get your money back.

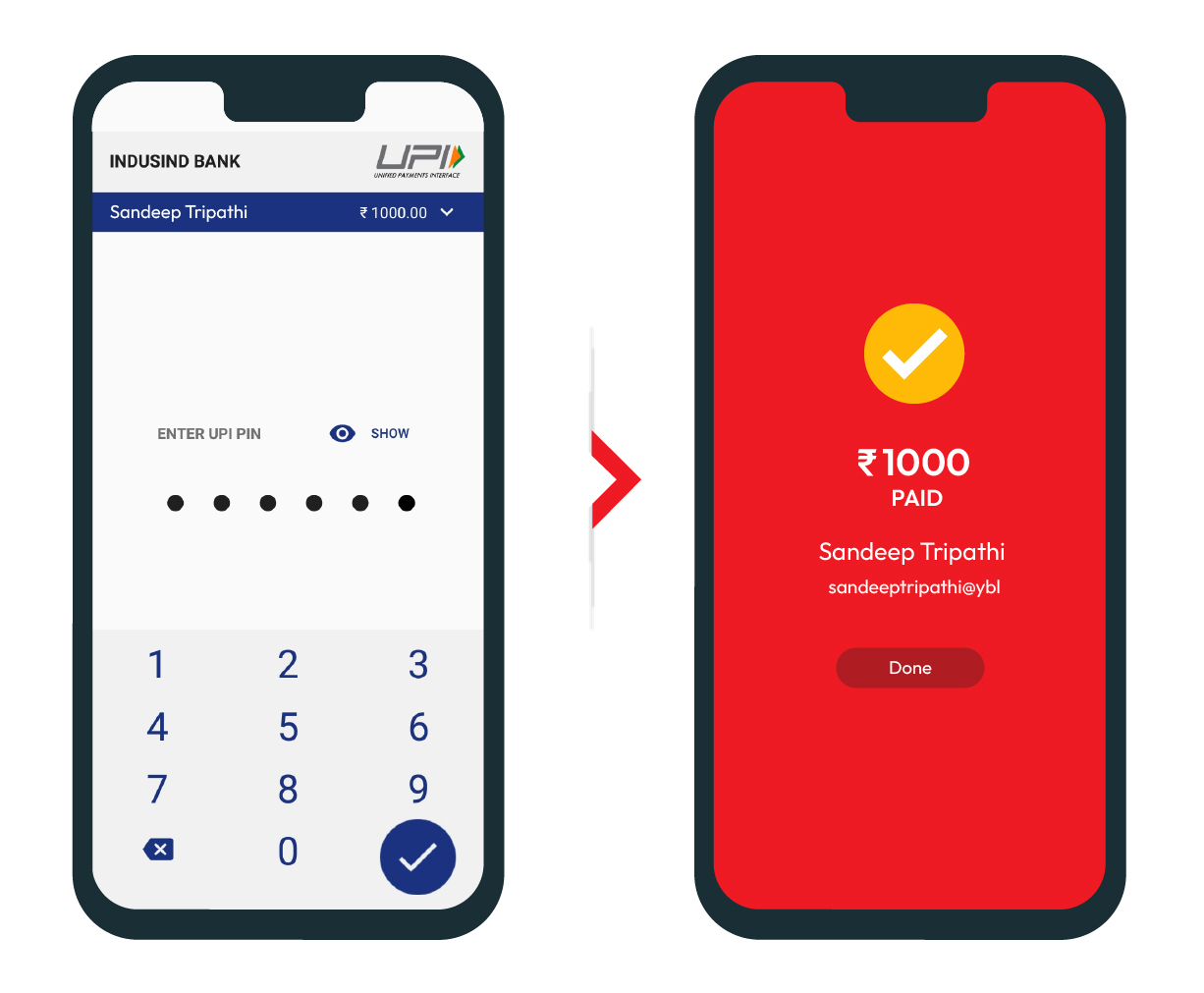

Step 1 – Immediately open the mobile application that you used to make the transaction. Raise a complaint regarding the UPI transaction with the Payment Service Provider (PSP) or 3rd party application provider (TPAP) apps. Select the specific UPI transaction in the mobile application and raise your concern/complaint. That generates a ticket which will be addressed by the PSP.

Step 2 – If the issue is unresolved within a specified time period, you may choose to escalate the issue at your bank with all the necessary details such as the transaction number, concern, etc. (Important Note- Never share OTP or PIN or any sensitive information with any support staff or bank officials)

Step 3 –If the complaint remains unresolved, you may choose to register a complaint with the NPCI’s UPI Dispute Redressal Mechanism.

Step 4 –If all 3 steps do not help resolve the issue, you may choose to contact a Banking Ombudsman and/or the Ombudsman for digital complaints to help expedite the process.

UPI Safety Shield: Stay Aware & Stay Safe

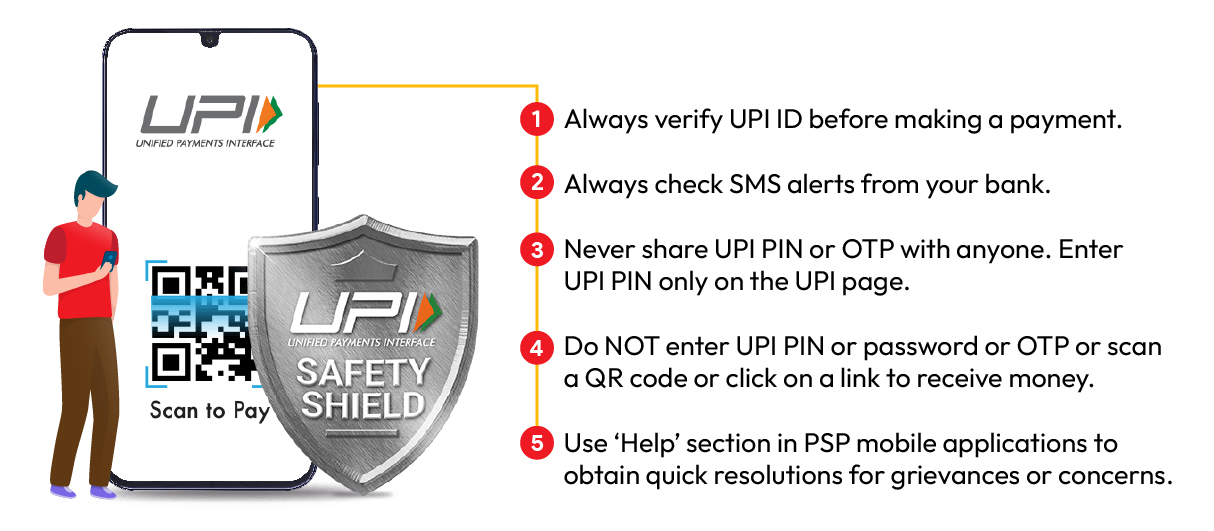

NPCI launched UPI Safety Shield to protect customer interests and create awareness about digital payments among general public. This can help protect your personal information and your hard-earned money.

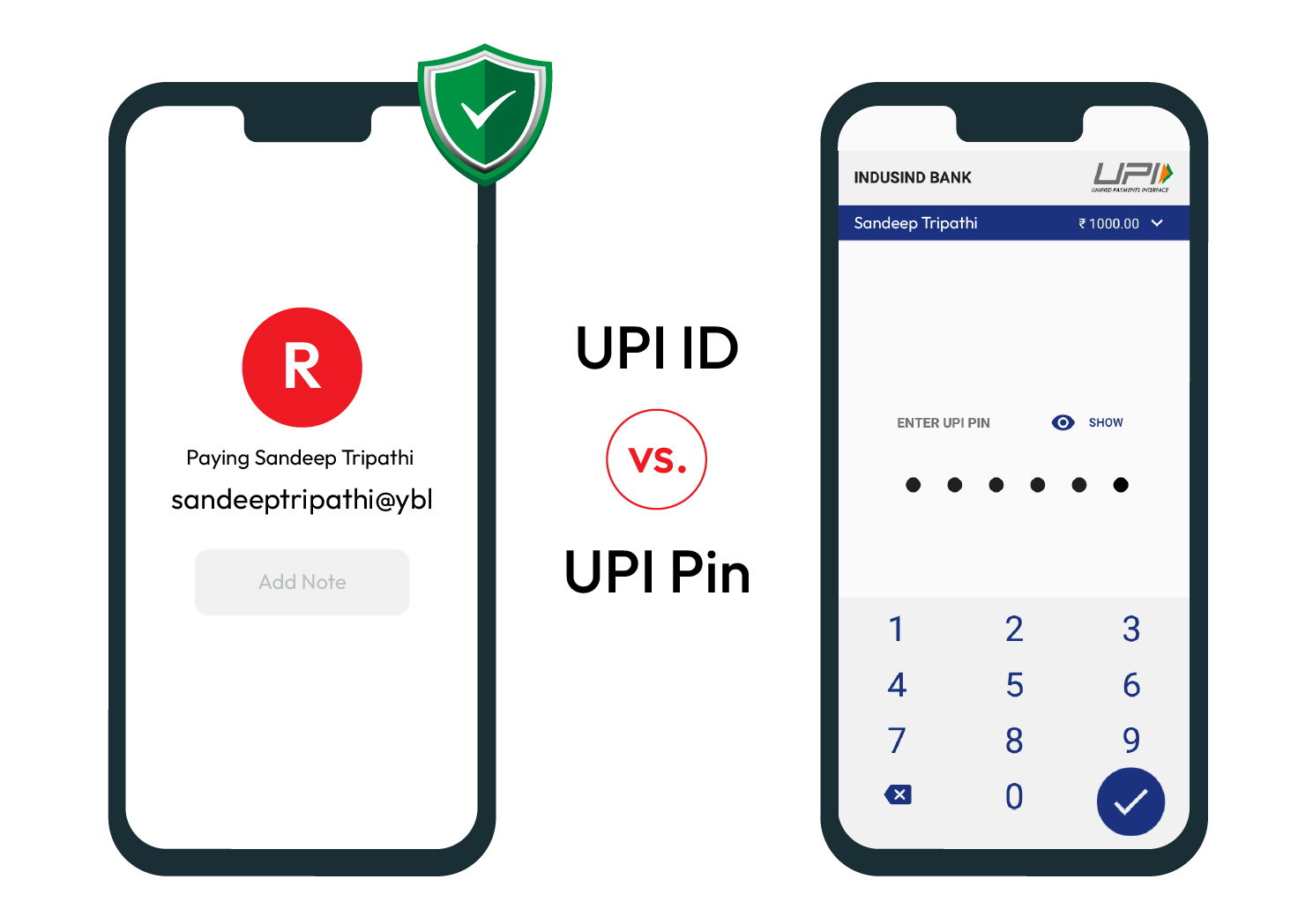

1. Always verify UPI ID before making a payment. The UPI ID is a unique identifier that CAN be shared with anyone to receive money. When making a payment, it is best to practice verifying by asking if it is the correct UPI ID

2. UPI PIN is the most important security measure to protect your sensitive payment information and your money. Never share UPI PIN or OTPwith anyone. Enter UPI PIN on the UPI page only.

3. Do NOT enter UPI PIN or password or OTP or scan a QR (Quick Response) code or click on a link to receive money. If someone asks you to do so, cancel the transaction immediately.

4. Always check SMS alerts from your bank. After every transaction, you will receive an SMS confirming the amount debited/credited from your account. Always verify the amount and notify the bank immediately if it is incorrect.

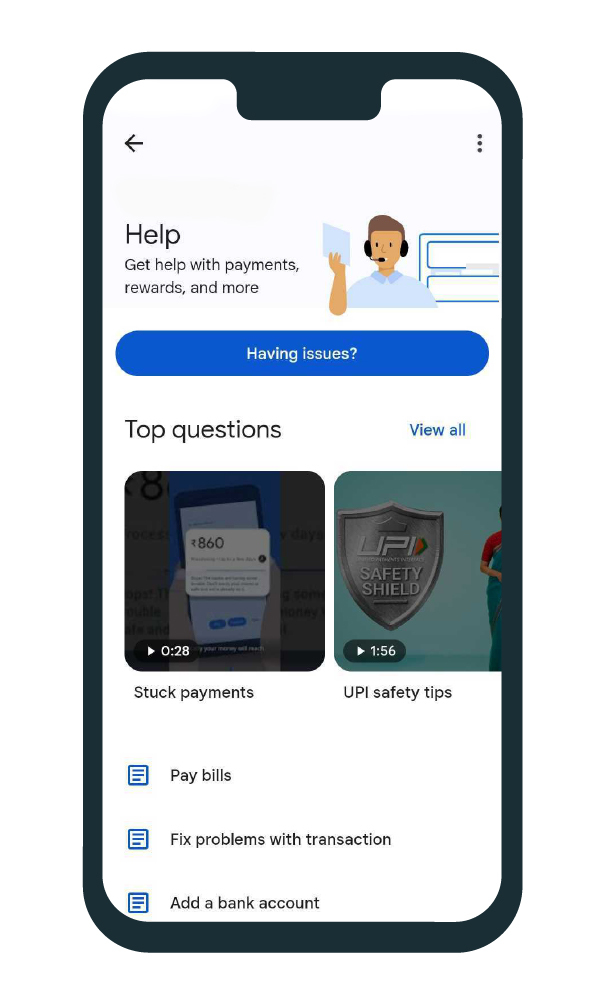

5. Use ‘Help’ section in PSP mobile application. For any transaction-related issues or concerns, click on the help section and raise a ticket explaining your concern to find a quick resolution.

Security features to protect businesses & customers.

The security and awareness extend to protect merchant and businesses as well. It is highly essential to remain alert to protect yourself against fraudulent activities. There are several types of security risks that businesses face with the rapid digital penetration in the country. The most common include email phishing scams, data breaches, etc. It is of critical importance to use a secure Payment Gateway to accept and process digital payments. Here is a detailed checklist on how to choose the right payment gateway for your business.

Now that you have a handy checklist to choose the best Payment Gateway and the importance of making an informed decision to have an efficient and secure payment processing system. We at Pay10offer innovative, ultra-proficient and multifaceted FinTech services empowering your business with easy, reliable, and secure digital payments.