Double-entry bookkeeping can be described as the system of registering transactions under two fundamental aspects- where one account involves all the transactions representing the received benefits, While another account involves transactions that represent the benefits that are given in the same set of books. In layman’s language this type of bookkeeping records twofold aspects of each transaction, receiving ie. of debtor and creditor, and thus it is called a ‘double entry system’.

Let’s understand with an example.

Mahesh purchased a washing machine, from XYZ Electronics worth ₹ 40,000. He paid the amount and received the washing machine. XYZ Electronics will say that they gave the washing machine and received cash ₹ 40,000. This suggests that there is a mutual exchange of relationship between the two parties.

From Party I (Washing machine) to Party II (Cash₹ 40,000)

From Party II (Cash₹ 40,000) to Party I (Washing Machine)

The system reveals two aspects in every transaction for every business, one aspect is “Debit Aspect” or “Expenses Aspect”, and another aspect is “Credit Aspect” or “Income Aspect” simultaneously.

Tracing the History of Double Accounting System

Double-entry bookkeeping can be traced back to the early Middle Ages dating back to the 13th century. Luca Pacioli was an Italian Mathematician, who published his thesis on the principles of the Double Entry system of accounting in 1494. The double-entry system has become the standard method of bookkeeping used by businesses across the world for being the most accurate method for maintaining records.

Advantages and Limitations of Double Entry System of Accounting

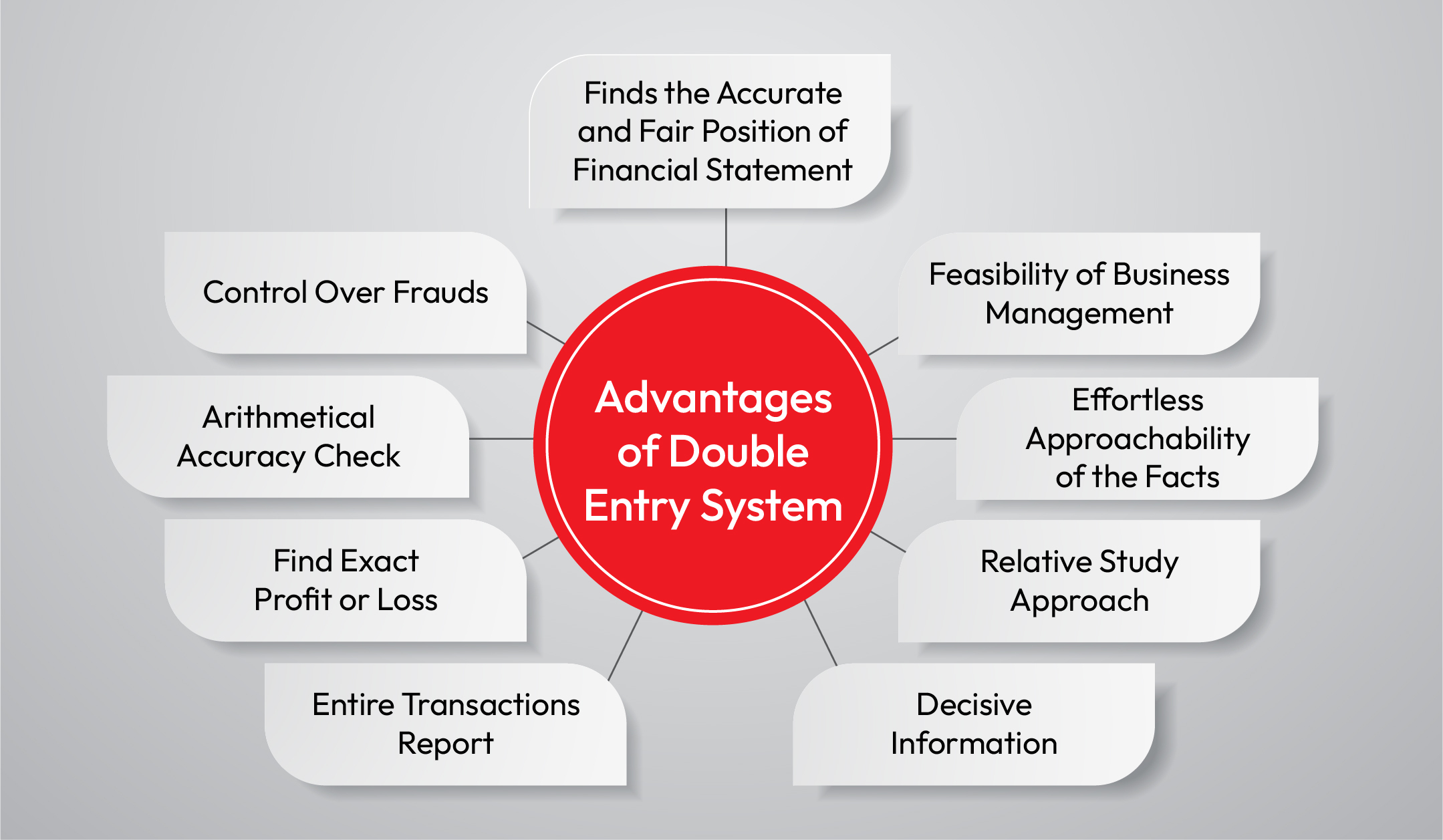

A double-entry accounting system is a systematic approach to various advantages.

1. Entire Transaction Report: The system incorporates all the financial transactions of the business along with the personal operations of the firm.

2. Depicts Exact Profit or Loss: With a Double entry accounting system, it is more convenient to prepare P&L statements with precise positions of gains and losses earned by the business during the fiscal year.

3.Arithmetical Accuracy: Since all the transactions are maintained through a double-entry system, it’s easier to maintain the records, which are further double-checked by preparing the trial balance.

4. Control Over Frauds: It is often termed a scientific, accurate and consistent method that follows specific rules and principles.

5. Financial statement Positioning: All the transactions are available for proctoring, and the administration has complete charge of the business and its P&L statements.

6.Feasibility of Business management: The business administration has full control over all the business operations with the entire set of details and all the precise transaction records.

7. Effortless approachability of facts: The management completely focuses on the growth of the business as gathering information and facts through the system get convenient.

8. Relative Study Approach: With all the records properly managed, executing a comparative study of the statement is easier. Businesses can compare the record with the statements of previous years and take necessary actions to achieve desired results.

9.· Decisive Information:The data collected under the statement is based on a scientific approach, which acts as crucial information that works for business enhancement.

Limitation of Double Entry Accounting System

1. Relatively Expensive than the single-entry system

2. Requires Expertise

3. The system requires the maintenance of various books, which is not practical for small firms.

4. No absolute guarantee of 100% accuracy despite agreement on the trial balance.

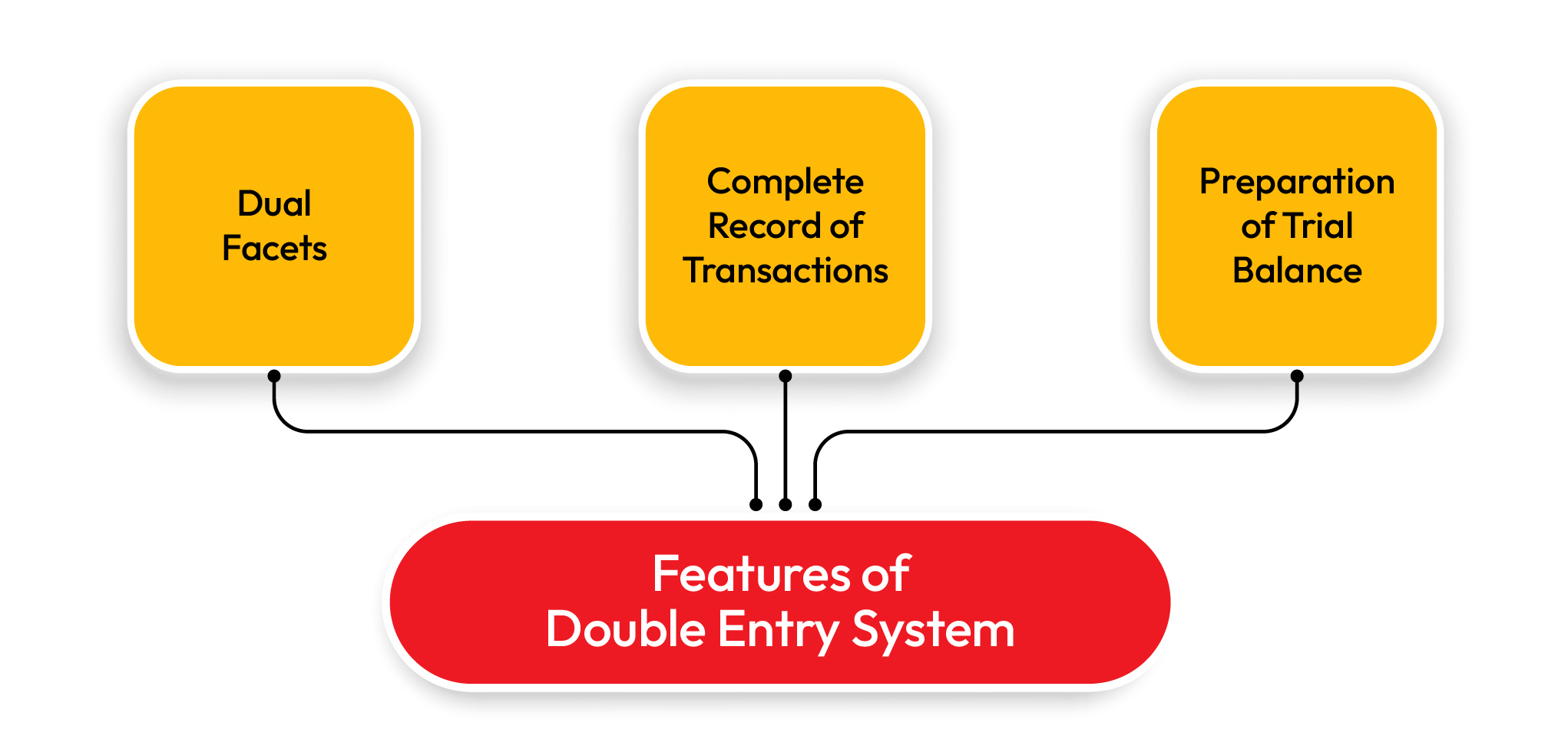

Features of Double Entry Accounting

1. Dual Facets : In the double-entry accounting system, every transaction has two aspects, if one transaction is marked as debited in one account, the same transaction will be marked as credited in another account.

2. Complete Record of Transactions : Information of both parties is recorded under the same system. Buying and selling parties both are recorded in the same place, if any error or gap comes across it is easier to find transactions according to the date.

3. Preparation of Trial Balance : Trial balance based on the rules of the double entry system of accounting includes debit, as well as credit transactions of the business. The trial balance sheet is prepared as the base for preparing further profit and loss accounts and balance sheets..

Rules of Double-entry Accounting System

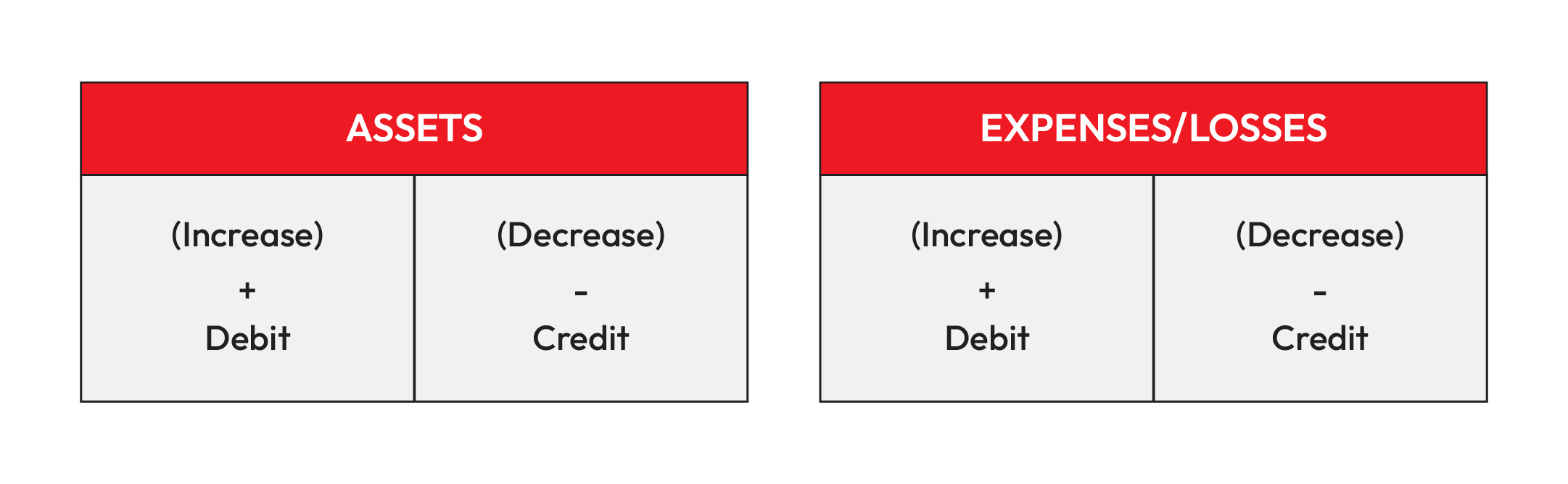

Every Transaction in a double-entry accounting system has two aspects under the debit and credit attributes. The positioning of the record defines whether the transaction will be recorded on the left or right side of the account. The account looks like the alphabet ‘T’ and thus it is also known as T-account. The total volume of assets in a double-entry accounting system must be in balance with the total number of liabilities and shareholders’ equity a company has at the time. Thus, the equation of the double-entry bookkeeping can also be expressed with the equation.

1. All accounts are divided into 5 categories for recording business transactions:

- Assets

- Liabilities

- Capital

- Expenses/losses

- Revenue/Gains

2. The credit side is to the right, and the debit side is to the left.

3. Every debit record has a similar credit entry.

4. Debit is the beneficiary; credit is the one who gives benefits.

5. In the case of personal accounts, the giver is credited, and the receiver is debited.

6. The expenses are recorded as a debit for a nominal account, and income is the credit entry.

7. In the case of the real account, inflows are debit, and outflows are credit.

Rules for changes in Assets/Expenses and Loss

Rules for Changes in Liability, Revenue/Gains and Capital

Why Does Your Business Need Double Entry System of Accounting?

1. Whether the business holds or owns the inventory.

2. Whether the business has multiple employees.

3. Whether the business has a structured chart of accounts.

4. Whether the business has any load or planning to apply for a loan sooner.

5. If the company is planning to integrate an automated accounting system.

If most of your answers are in the affirmative, then the double accounting system should be your ideal choice. Double accounting entry system handles balance sheets conveniently, like holding inventories, disbursing salaries, and complying with loan agreements. For companies that have a long list of general ledger accounts. Follow our blogs to know more about such interesting topics. Pay10 offers an ultra-efficient Payment Gateway with easy and hassle-free integration for all existing platforms of Retail & E-Commerce businesses. We provide world-class security features that support credit/debit cards, internet banking, UPI, wallet, etc. and are equipped with a fully analytical dashboard for the merchant’s convenience.

Frequently Asked Questions

- Q1. What is Double Entry Accounting System?

- Double Entry Accounting System is the system of registering transactions under two fundamental aspects- where one account involves all the transactions representing received benefits and another account involves transactions that represent the benefits that are given in the same set of books.

- Q2. What are the advantages of a Double Entry Accounting System?

- Few of the most common advantages of Double Entry Accounting System are:

- Depiction of Exact Profit or Loss

- Feasibility of Business management

- Aids in Decisive Information

- Presents Financial statement Positioning

- Gives Control Over Fraud

- Arithmetical Accuracy

- Few of the most common advantages of Double Entry Accounting System are:

- Q3. What are the Rules of Double-entry Accounting System?

- All accounts are divided into 5 categories for recording business transactions.

- The credit side is to the right, and the debit side is to the left.

- Every debit record has a similar credit entry.

- Debit is the beneficiary; credit is the one who gives benefits.

- In the case of personal accounts, the giver is credited, and the receiver is debited.

- The expenses are recorded as a debit for a nominal account, and income is the credit entry.

- In the case of the real account, inflows are debit, and outflows are credit.

- All accounts are divided into 5 categories for recording business transactions.