FinTech solutions have been addressing the need for a more flexible and convenient payment system while filling the gap between traditional banking and the digital economy. With a significant connection of traditional and modern banking, FinTech is bridging the gap between the urban and rural belts of the country. FinTech is conducting its business processes complying with laws and regulations within the operating country, professional standards, international standards, and acceptable business practices. It also helps to perform audits regularly while executing design control systems for potential risks that might occur. Continue reading to learn about the importance of regulatory compliance in Fintech.

What are Risk and Compliance?

Fintech is reliant on technology for increased security, but undeniably the industry keeps evolving over time, and it is arduous to hire risk professionals with on-point skills. Risk and Compliance have different characteristics and require different management styles. Risk is managed with a procedure inclusive of a proactive and predictive approach, while compliance is managed with a prescriptive and reactive approach.

4 Reasons why Compliance is Essential in FinTech

Customer Due Diligence

CDD is the process used for collecting and evaluating relevant information about a customer or potential customer. The basic framework of the network can be managed through the customer life cycle, to validate and verify customer information. If done promptly, it can be the first and most crucial step to reducing abuses and fraud. Like traditional banks, customer validation is important in e-banking to perform customer monitoring. Omitting or disregarding is like CDD is like speed dating on your way to nuptials. Customer traits, customer details and identity must be verified to keep consequences at bay.

Fraud Detection and Prevention

KYC measures are formulated to protect financial institutions against money laundering, fraud and corruption. If FinTech keeps qualitative and transparent compliance in place, consequent risks can be eliminated before any damage occurs. Robust controls daunt fraudsters resulting in a competitive advantage. KYC compliance plays a critical role in real-time, cross-border payment as it facilitates greater trust, transparency, and collaboration while mitigating risk.

Primary steps involved in KYC.

- Establishing customer identity.

- Understanding the nature of the customer’s qualifications and activities.

- Understanding the source of funds.

- Assessing money laundering risks associated with customers.

Avoid Regulatory Fine

Regulatory pressure keeps increasing over time in the financial service industry. Fines of regulatory authorities are among the most serious consequences and are a product of non-compliance and carelessness towards the regulatory protocols. Failure to comply with the regulatory norms can be extremely costly and tend to be a potential cost to lose licenses. Deploying tools and software that are compliant with industry standards diminish the chances of risks and fines.

Build Brand Reputation

FinTechs can build a robust image in the market, by maintaining a superior ethical standard and operating an effective compliance program. When the reputation is built on a perfectly operating system and solid track record, the brand inevitably elevates to attract more traffic and good publicity. Credence doubles when a company complies with standards that are best in the industry. With a surge in cyberattacks and money laundering cases, customers are sceptical about the brands unless they have been secured and approved by the government.

Advantages of Regulations and Compliances in FinTech

Compliance can be defined as a process that ensures that a Fintech brand is adhering to the relevant laws, regulations, and standards however, it can vary depending upon the factors such as subsectors or Geographical locations. Regulations and compliance in FinTech lay the foundations for trust by ensuring that the brand is operating ethically and maintaining the liquidity of a financial system. FinTech companies are subject to various regulations, including but not limited to data protection, consumer protection, anti-money laundering (AML), and know-your-customer (KYC) requirements.

Key Regulations and Compliances Important for FinTech Companies

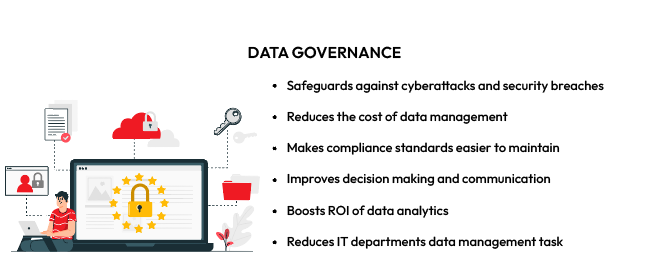

1. Data Governance:Data Governance or Data protection refers to the methods that brands incorporate to keep information safe. It is a wide scope of processes that corroborates the availability, usability and consistency of data. Protection and Privacy of Customers' information are a few of the most heavily regulated aspects of the financial industry worldwide.

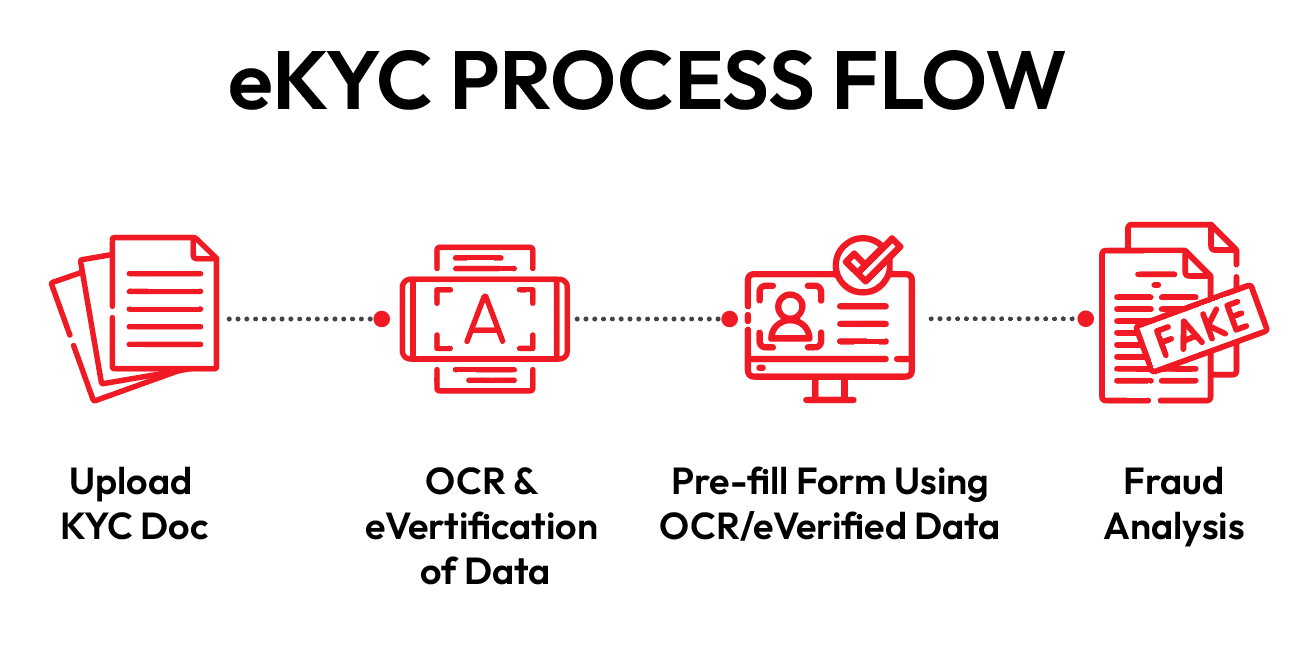

2. KYC Regulation: KYC or Know Your Customer is a fundamental regulatory requirement for financial firms. This method aims to verify the identity and risk profile of the user to ensure that it is reliable. KYC is generally used FinTech stakeholders to prevent money laundering and fraud.

A typical KYC Process follows the following steps.

For FinTech companies, incorporating KYC is an easy process that can be executed as a part of Merchant or User onboarding. Also, since the criminals are tech advanced and can potentially fool with utter sophistication, Mindful submissions at the customers' end play a very critical role. By using synthetic IDs, or using wax figures on videos, swindlers can get away with skulduggeries. For digital payment platforms in India e-KYC can streamline the processes by digitally verifying the identities.

AML regulations: AML or Anti Money Laundering regulations are a process followed by financial institutions to keep track of their customer’s financial activities. Compliance is required to identify and prevent situations that can lead to money laundering. Fintech crimes evolve alongside technological innovations. AML for Fintech encompasses everything that an organisation should do to.

Payment Card Industry Data Security Standards (PCI DSS): PCI DSS Compliance governs credit card payments, ensuring that transactions are processed in a secure and safe environment. FinTech companies that accept payment cards.

12 requirements outlined by PCI DSS for handling cardholder data and maintaining a secure network. These requirements are categorised under six broader goals.

| PCI DSS Goals and Requirements | |

|---|---|

| Risk Adaption is Quick | Compliance adaption is Slow |

| Secure network | Installation and Maintenance of firewall configuration |

| Original System passwords (not vendor-supplied) | |

| Secure Cardholder Data | Protections of Stored cardholder data |

| Encrypted Transmissions of cardholder data across public networks | |

| Vulnerability Management | Anti-virus software must be used and regularly updated |

| Development and maintenance of Secure systems and applications | |

| Access Control | Cardholder data access must be restricted to a business need-to-know basis |

| A unique ID is a must for every person with computer access | |

| Restricted Physical access to cardholder data | |

| Network Monitoring & Testing | Access to cardholder data and network resources must be tracked and monitored |

| Regular scrutiny of Security systems and processes | |

| Information security | Maintenance of policy to deal with information security |

ISO 27001

ISO 27001 is an international standard information risk management framework designed to guide the selection of adequate and proportionate controls for protecting information. It encompasses all legal, technical, and physical controls of an organization’s information risk management processes. The compliance standard aims to leverage a better model that establishes, implements, operates, monitors, maintains and perpetually improves the information security management system.

Key Features that Highlight the Need for ISO 27001

- Identifies the potential information security risks.

- Provides a secure framework for ideal management of controls

- Manages compliance with laws and regulations.

- Outlines the objectives of information security management

- Underlines the information security policies, standards, and processes to be followed by businesses.

It is imperative for fintech companies to be aware of all the applicable regulatory requirements to operate their businesses successfully and to avoid any penalties. For Fintech companies, the Regulatory environment can make or break the business and strategic planning is required to adhere to the latest industry standards. Pay10 is certified by best-in-class industry standards of compliance with PCI DSS, ISO 27001, SAR (PAPG & Data localization) and VSCC to ensure that your private data is not compromised. Besides, the fintech platform is secured with cutting-edge technology to ensure confidentiality and enhances checkout experiences. To know more visit our official website.