Payment Gateway Benefits for Micro, Small, & Medium Enterprises

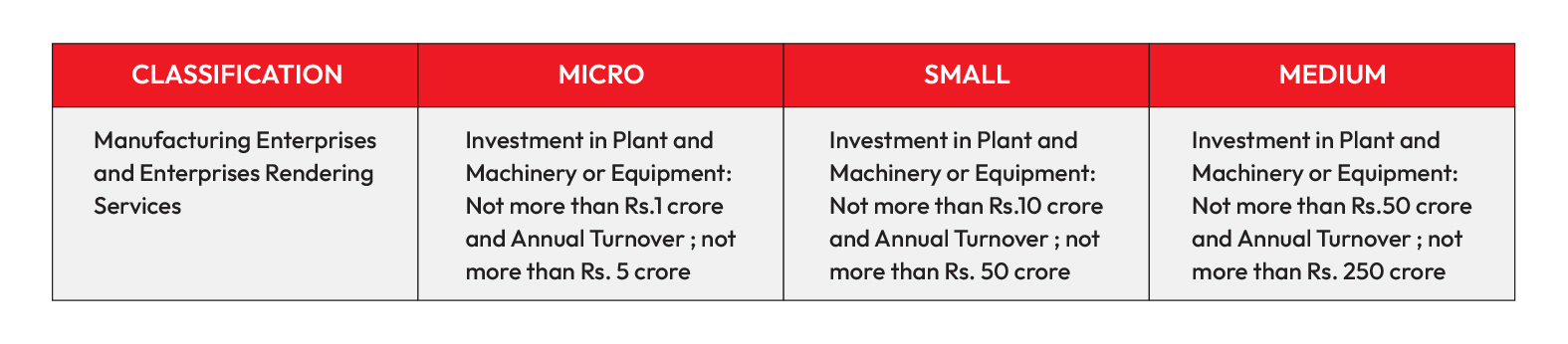

Micro, Small, & Medium Enterprises (MSMEs’)- The collective industry is the cornerstone of Indian economy. The digitalization of financial services has ushered in an avalanche of changes that impacts everyday life and its influence on small enterprises is undoubtedly significant. The more critical question to be answered is how profound is the impact of digitalization on small businesses and what is the future roadmap for MSMEs’?

For inclusive growth, Digitalization needs to reach the underbanked and unbanked demographics of the country. According to IBEF, the micro sector alone includes 630.5 Lakh enterprises and around 52.3% of the micro enterprises are in rural areas. The MSMEs’ contribute roughly 30% of the national GDP. The digital payment inclusivity extended to businesses in the MSME sector is crucial to overall success. Payment Aggregators provide an optimal solution for driving MSMEs’ expansion in India. Here is 5 ways Payment Gateway can help drive MSME expansion in India