Top 7 Payment Trends for the Enterprise in 2022

The world has witnessed the glaring revolution of digital transformation well-nigh in every vertical including digital payment. Online payments have come a long run offering contactless in-store, and flexile online payment options. With advancements in machine learning and AI, businesses of all sizes can readily adapt to evolving customer preferences and behaviours. Digital Payments are growing and soon they are expected to account for more than 70% by the year 2025. With the surge, it is recommended that enterprises must stay prompt with the latest technologies and innovations along with incessantly evolving customer behaviour. These evolutions evoke payment trends that affect customers and businesses. Here is the list of top payment trends for enterprise in 2022, that must be known to all.

7 Trends Popular in 2022

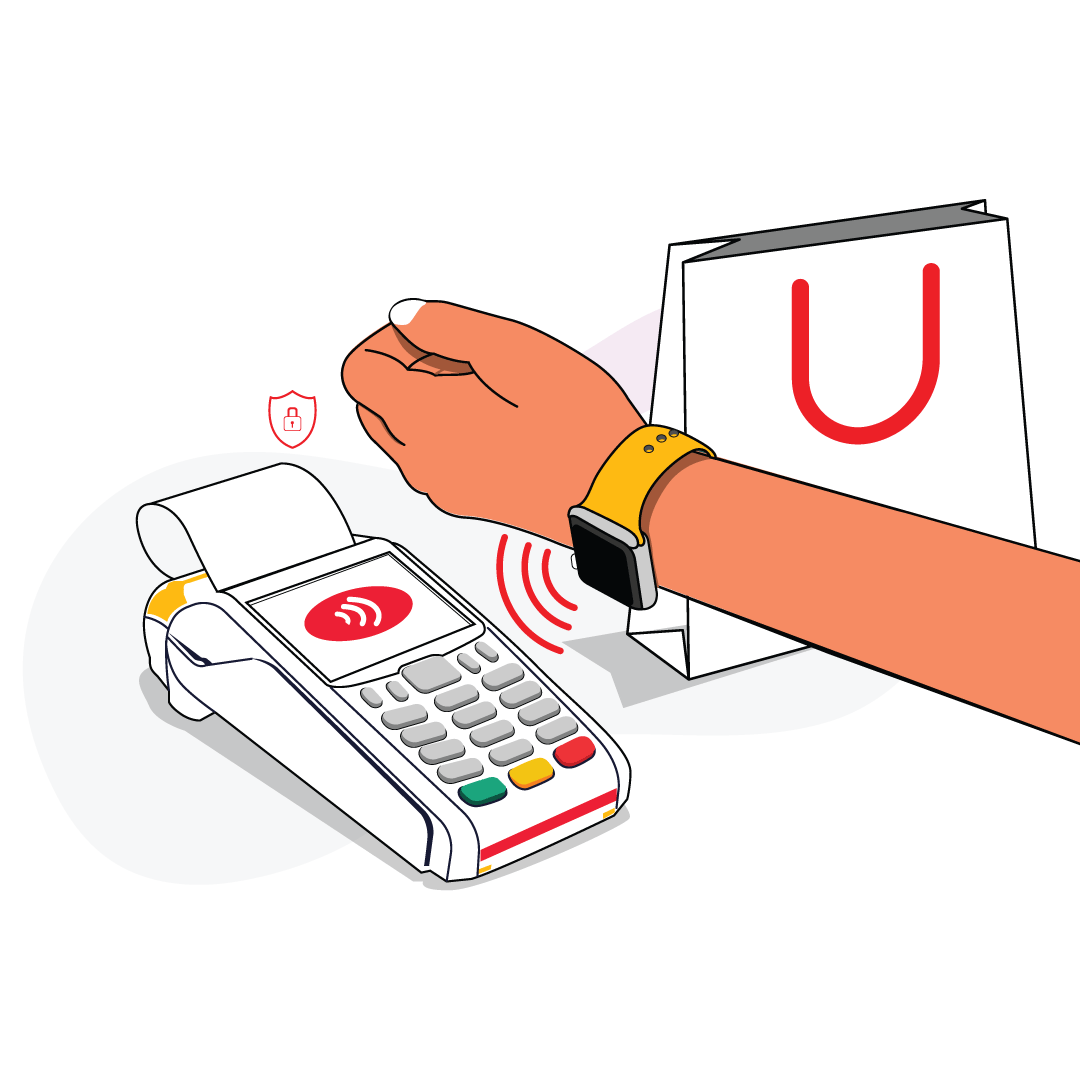

- Wearable Payments devices

- Biometric Authentication

- Payments and Reward Points

- Card Tokenisation

- BNPL aka BUY Now Pay Later

- Card Based Mandates

- Dynamic Payment Routing

Also Known as Wear ‘N’ Pay, the tap-and-go technology is integrated into wearable devices such as wristwatches, smartwatches and the variants are growing. The device is the spin off that emerged from the need of making transactions compatible with the handy and portable devices. The convenience reaches new hights with the weighty concept of wearable contactless devices, enabling the banks to acknowledge consumers behaviour and design better solutions accordingly.

Benefits of Wearable Payments Devices

Contactless payment devices are used as tracking gadgets powered by GPS that help customising the services and result in elevating the customer experience. These devices are easy to carry and make seamless interaction with the reading equipment despite null physical contact.

Biometric Authentication is a security feature that roots on the unique biological traits of an individual. It purveys two-factor payment verification to substantiate the payments. The feature compares the physical traits to the data pre-saved in the data base, followed by confirming and authenticating it. Since digital payments are adapting the innovative transposes, businesses must understand the process flow of Payment Gateways.

Benefits of Biometric Authentication

Implementation of the technology amps up the security system and reduces the fraudulent activities for consumer as well as businesses. The delineated payment trend builds trust and loyalty among the customers and ensures liability for Payment Gateways in India.

Well, this is one of our most favourite trends that we all have been loving and look forward to. Reward points are the loyalty points widely being used by brands to foster engagement. Even though sometimes the redeeming process might turn out as a pain, but it works well. This directly affects the growth of a digital ecosystem, as these rewards points can be further utilised to make payments for online and offline purchases.

Benefits of Payments and Reward Points

This trend benefits for point issuers as well as the businesses that accept them as payment. Point issuers convey value to customers, and this is how businesses can acquire customers and earn their loyalty. This increases customer loyalty and upgrades level of satisfaction for the point issuers. The impact is revenue and sales for the businesses accepting the reward points.

With the incessantly growing fraudulent activities, card tokenisation has become an integral part of the financial systems. Card tokenisation is an end-to-end encryption that secures the valuable data that is accessed, shared and stored for seamless digital transactions. This trend is gradually catching up as companies consider it to be an impervious tool that can be implemented to fortify one of the weakest spots in the digitisation of payments.

Benefits of Card Tokenisation

The Payment Gateway will use the pre-saved card details of the buyer allowing them to pay conveniently. This reduces the rate of card abandonment and augment the security of the card users.

Certainly, BNPL is one of the greatest trends which is being followed in 2022, and undoubtedly, it has taken the E-Commerce world by the storm. This trend empowers the debt averse consumers by breaking the immediate costs into smaller and affordable instalments. Customers can purchase the items and services that are beyond their affordability range, without having to wait for their salaries. It spreads the cost, over a long period of time, and eventually enhances addressable targets.

Benefits of BNPL

Customers pay interest free instalments and companies using the feature generate higher revenues leveraging untapped customers, without them having to pay any extra amount. Also, customers don’t require any credit history to use the Buy Now Pay later facility.

E-Mandates, these refer to the standing instructions or recurring payment instructions on a debit or credit card given by cardholder on a merchant platform. It directly impacts the financial institution by rendering explicit transparency for an exceptional customer experience and brand loyalty. There are chances of losing potential revenue and customers, if your business lacks recurring payment.

Benefits of Card Based Mandates

There are many benefits that fall under the umbrella of Card-Based Mandates such as reduced friction in the payment processes. This feature increases customer retention while saving money and using the auto reconciliation attribute.

Payment Routing is a quintessential payment process for businesses that work with multiple payment aggregators. Based on the selected parameters, the routing system allows sending each transaction to the best payment gateway in India and outside. It has a dual essence and has a seamless payment succession while developing a synergy between acquiring bank, issuing bank and Payment Gateways.

Benefits of Dynamic Payment Routing

The methodology of routing transactions is directly related to payment conversion and the success rate by enabling multiple PSPs. This results in reducing rate of failed transaction, faster approvals, real-time insights and customised solutions by allowing merchants to use tools from more than one provider.

PAY10 is an exceptional digital payment solution provider that empowers businesses to receive online and offline payments. The aggregator is the best in the Fintech industry for its seamless checkouts and device agnostic platform. The Omni-channel digital payment solution provider caters to a wide range of verticals. For more information check out the official website or get on touch with the team.