The FinTech Industry is transforming the financial landscape driven by technological innovations deluging the marketplace. The future of this nascent sector in the Finance industry is promising with increased internet penetration in the country paired with quick and seamless digital payment experience across all demographics. The paradigm shift in the assimilation and usage of digital financial transaction has been far reaching leading to a positive outlook for the future.

According to EY, the FinTech market in India is poised to reach $200 billion in revenue by 2030. The collaborative ecosystem supported by key government initiatives powers the growth of FinTech firms leading to remarkable innovations that help create the new digital economy. This digital revolution in the finance sector has substantially contributed to promoting financial inclusion. To understand the phenomenal progress of FinTech industry, we need to learn where the growth began. Here is a quick look at the past, present, and future of money.

FinTech: The Past- History of Money

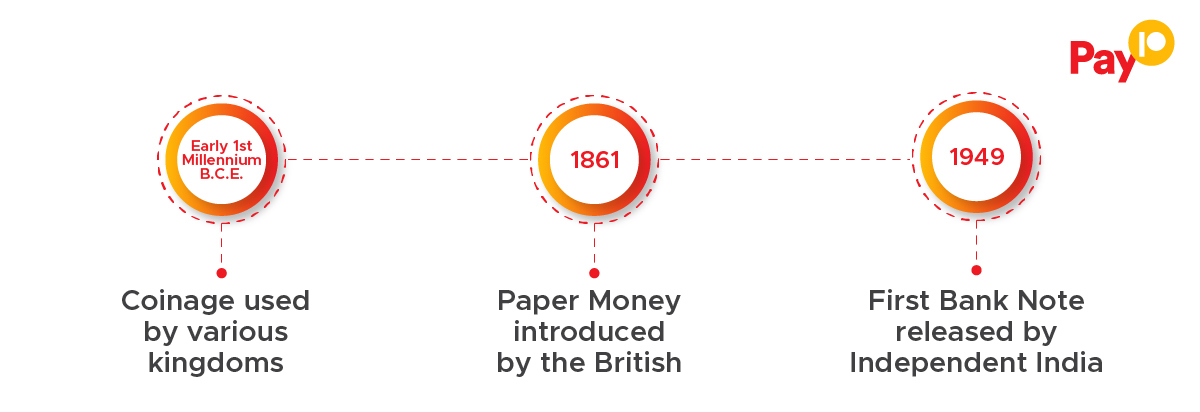

The barter system is a familiar term to everyone as we track the beginning of ‘money.’ Interestingly, the foundation in India is believed to have been built way back between 2nd century B.C to 2nd Century A.D. with coins. The paper scraps were introduced by the British empire in 1861, to further impose colonial rule in India.

Although the introduction had disastrous effect on the Indian subcontinent, it became a social unifier to previously fragmented kingdoms and princely states that eventually led to overthrowing the imperial rule. Post-independence, the first bank note with the Indian emblem was introduced in 1949. Here is a fact capsule of the evolution of money, as an accepted form of payment in exchange for goods and services.

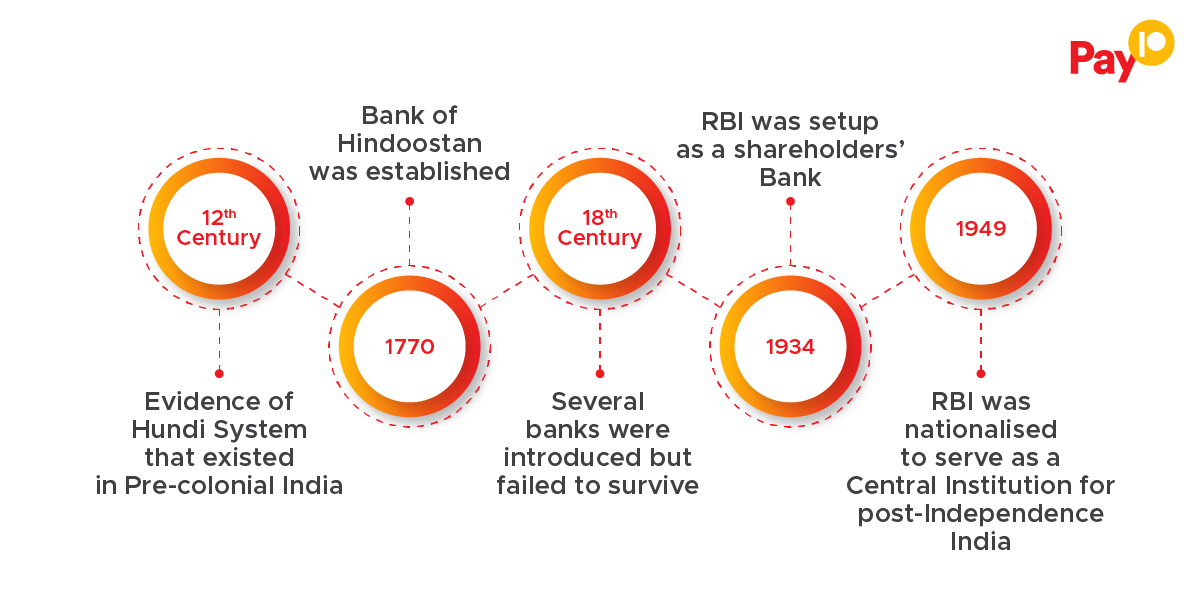

The history of money is intertwined with the banking system. The earliest records show an intricate credit system called hundi existed in India, as early as 12th Century. The modern banking as we know it was established in 1770 as Bank of Hindoostan, several national, imperial, and private banks mushroomed in the 18th century and most failed to survive.

Reserve Bank of India was set up as shareholders bank in 1934 under the Imperial directive to operate the credit and currency system in the country to its advantage. Post-Independence, the RBI was nationalized in 1949 to serve as a central institution for financial supervision, payment settlements, and more.

FinTech: The Present- Money as we know it.

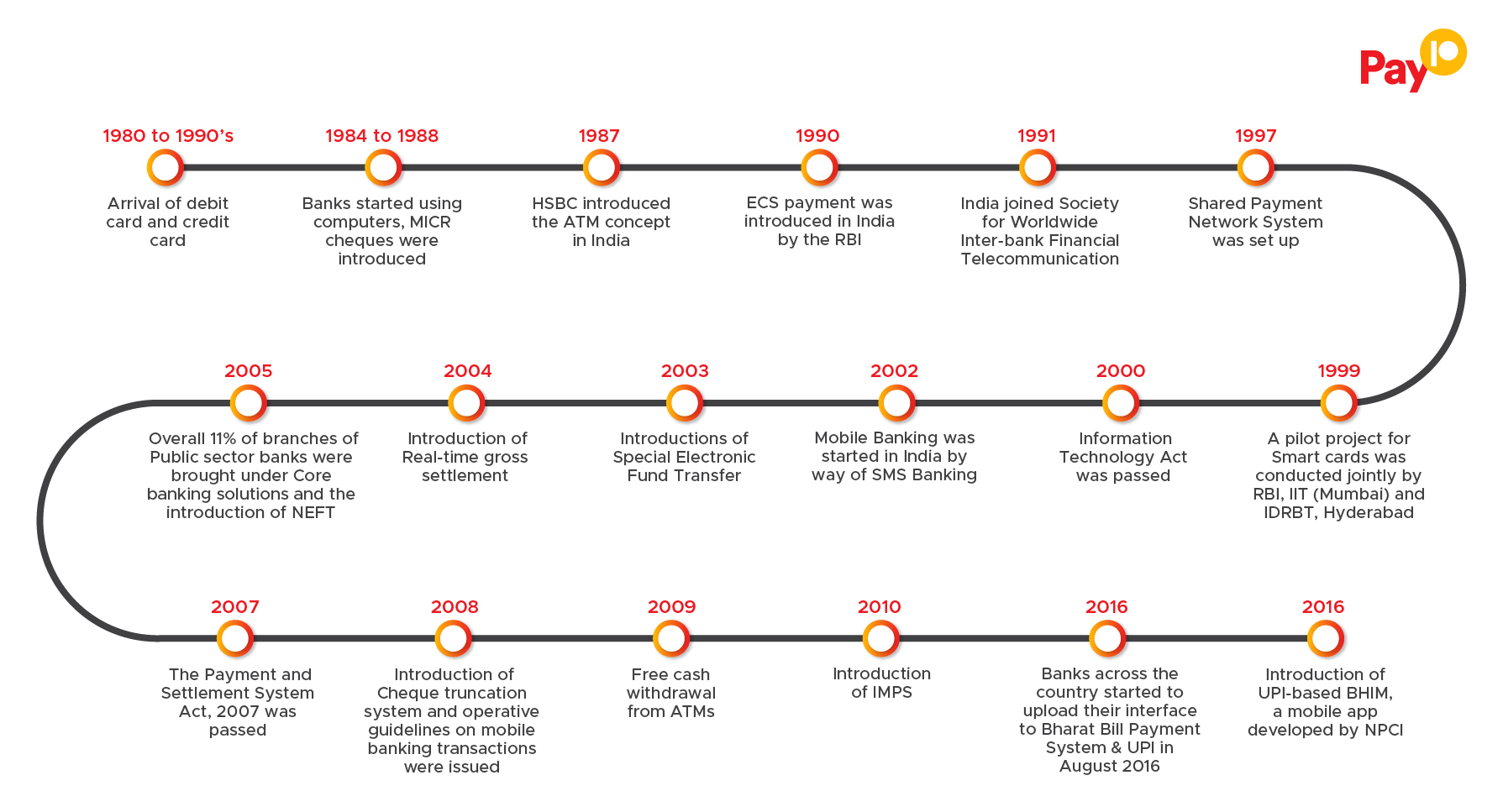

The post-independence India stepped into a prudent yet hopeful economic landscape to streamline and regulate the money and the banking system as we know it. Paper money- cash was the chief mode of payment. Other non-cash payment instruments such as cheques, promissory notes were still an accepted and popular modes of paper-based transactions. In 1991, liberalization and globalization brought in banking reforms that led to several notable changes that were aimed at making banks both profitable and efficient. Here is a quick trip down the lane to understand the evolution of payment systems in India.

FinTech: The Future- Cashless Digital Economy

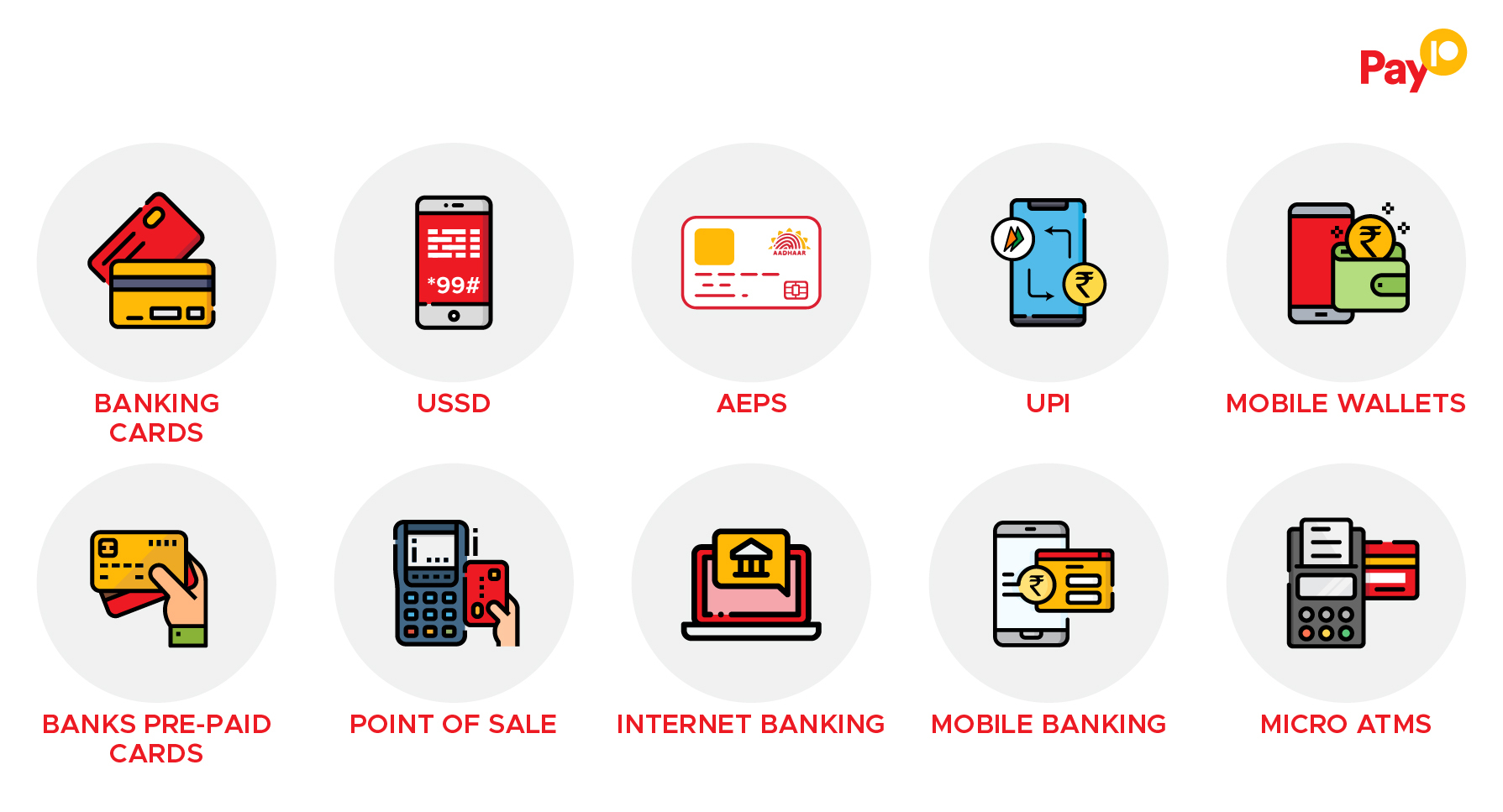

In 2016, the pivotal change was heralded with the introduction of UPI (Unified Payment Services). National Payments Corporation of India (NPCI) developed the digital payment solution for BHIM-UPI that would lead to the paradigm shift to money, banking, and payments as we know it today. The strict regulations posed by RBI and burgeoning innovations in the FinTech sector are primed to host an efficient and secure digital landscape that makes the cashless economy our new reality. Payment Modes currently available today in the marketplace:

The cashless economy is currently teeming with novelties such as FinTech, LendTech, InsurTech, and more. The Payment instruments available in the marketplace are easy-to-use, quick to process, and to perform a hassle-free digital transaction. The most important and vital contribution of the digital payment system is drawing in previously underbanked & unbanked sectors to perform secure & organized business transactions.

We at Pay10 are enthusiastic to contribute our share in realizing the future of cashless digital economy in India. You can look at our innovative and ultra-efficient Payment Gateway with reliable security features, supporting several payment modes, and powers an analytical dashboard; Payment Links, Payout services, Billing service, Reseller services, and more.