Basics of FinTech

FinTech Buzzwords- Learn all the terms that you need to know to ace your time in the FinTech industry. Your all-in-one glossary exclusively for FinTech terms, acronyms, and more from letters N to P.

Native OTP

Native One Time Password is the process of generating and performing OTP verification without redirecting the customer to the 3D-Secure / ACS page for authentication. Since there is no redirection, it reduces dependency on the customer’s browser network and reduces the drop off rates for a seamless consumer payment experience.

NBFC

Non-Banking Financial Companies (NBFC) are companies registered under the Companies Act, 1956. They offer various banking services such as loans, advances, acquisition of Shares/Stocks/Bonds/Debentures/Securities but are not allowed to take conventional demand deposits- readily available funds, check-in, or savings accounts, from the public. They do not have a banking license.

NEFT

National Electronic Funds Transfer (NEFT) is an e-payment system that allows direct one-to-one payment transfer across the country. It can be electronic transfer of funds from a bank to any individual with an account in the bank which is a part of the NEFT scheme or using mobile banking or internet banking.

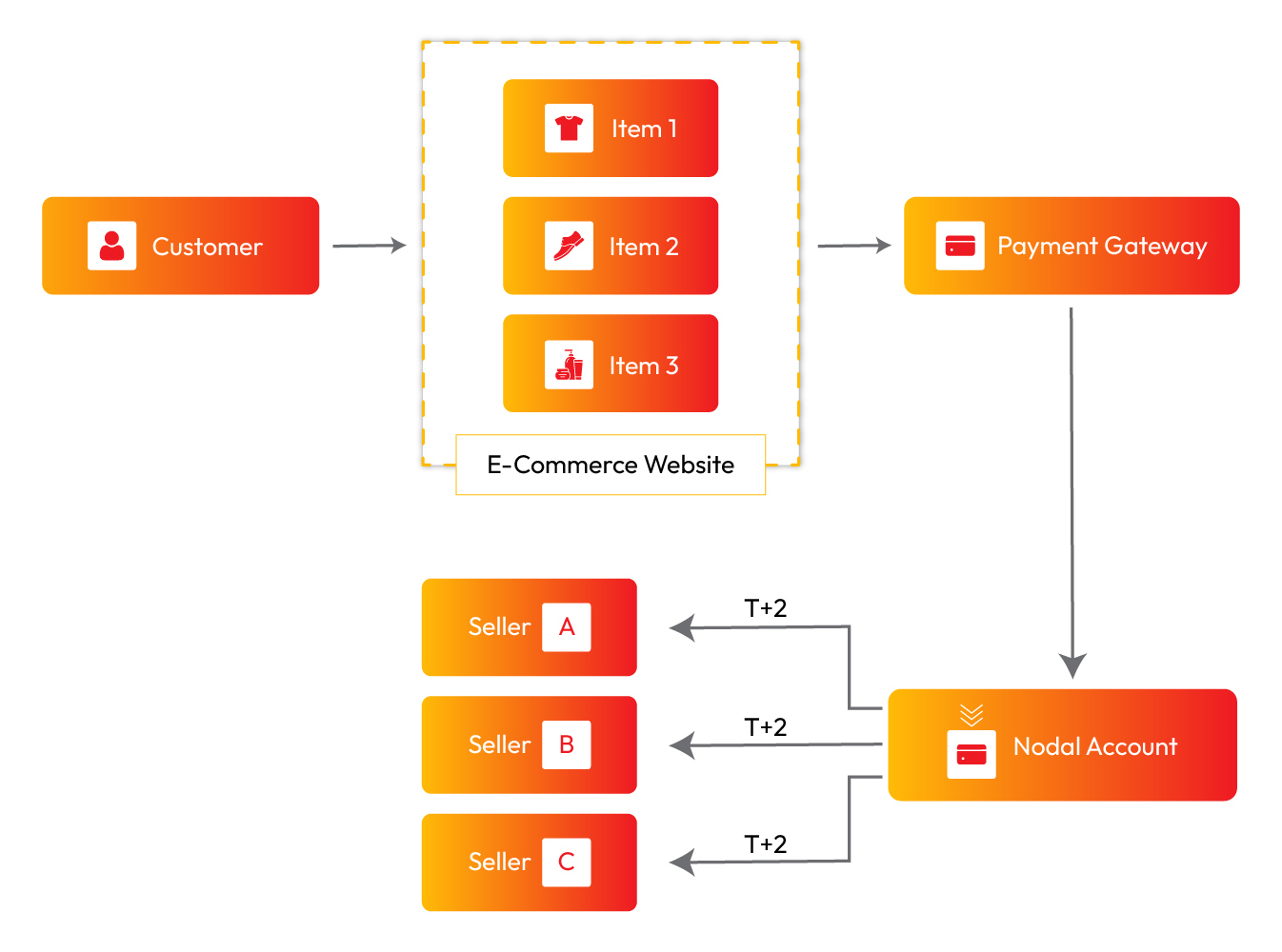

Nodal Account

Payment aggregators, e-Commerce Platforms and Payment Gateways are mandated by the Reserve Bank of India (RBI) to use a Nodal Account. It is a type of Current Account that is used to hold funds on behalf of customers and vendors (Payouts). This ensures that money does not legally belong to the intermediary at any point in time.

NPCI

National Payments Corporation of India (NPCI) is a division of Reserve Bank of India (RBI) which is under the authority of Ministry of Finance, Government of India. It is responsible for operating retail payments and settlement systems in India.

Offline EMIs

Commonly referred to as Digital EMI or Buy Now Pay Later, Offline EMIs’ are credit payment options offered by auto dealers, fashion, restaurants, retail stores and e-commerce websites for white goods and electronic stores.

Online Investment Platform

The online Investment Platform enables placing orders via the internet to buy and sell securities.

Open Banking

Open Banking is a banking practice that provides open access to consumer banking, transaction, and other financial data from banks and non-bank financial institutions through use of APIs. It is an innovation poised to revolutionize the banking industry.

Open Loop Card

Open loop cards are general purpose cards such as debit/credit/prepaid cards that can be used anywhere the card is accepted. Whereas a closed loop card can only be used with a specific retailer.

OSS

Open-Source Software (OSS) is designed to be publicly accessible to see, modify, distribute the code as they see fit. It is developed in a decentralized and collaborative by communities through peer review.

OTP

One Time Password is an auto-generated numeric or alpha-numeric characters that authenticates a user for performing a single transaction or a log-in session. It is often used as a 2nd layer of security for any given transaction.

Passwordless Authentication

It is a method of user verification where user can login with fingerprint, token delivered via., text or email instead of using a password. This enhances security as it avoids user repeating the same password for multiple sites or misplacing the login credentials.

Payment Gateway

Payment Gateway is a technology that facilitates accepting payments from different payment modes- Credit/Debit Cards, Net Banking, UPI, Mobile Wallets, etc. Payment Gateway provider equips the merchant with an analytical dashboard that generates reports and detailed statistics of payments, settlements, refunds, and more to support business decisions.

Payment Switch

When there are multiple merchant accounts in a payment gateway boarded with their bank (acquirer bank), a payment request is received from a selling platform. The Payment Switch dynamically identifies the acquirer bank (associated with that merchant) and the issuing bank, of that specific request through BIN allotment and then permits the transaction to happen securely.

PCI DSS

Payment Card Industry Security Standard is a proprietary information security standard for organizations that handle card (Debit/Credit) payments. A PCI DSS certification assures safe storage and processing of card details.

PIN

A Personal Identification Number is a numeric passcode that is used to authenticate the user accessing a system.

POS

Point of Sale is the time and place when a retail transaction is complete. POS System allows businesses to accept payments from customers and keep track of the sales in the store.

Pre-authorization

Pre-authorization or Authorization Hold is a temporary hold placed on a customer’s credit card until the settlement comes through.

Prepaid Card

Prepaid allows the user to spend the amount of money stored on the card. Once the balance is used up in a reloadable card such as Forex card, Meal Card, Travel Card- the user can reload the card. While a non-reloadable card such as a Gift Card can be used for the stipulated amount before the expiry date.

The FinTech jargon from N-P, we have gotten you covered. Take a quick look at us A-C section, D-F Section & G-M Section to catch up. Keep following to know more and become a FinTech Pro with acronyms and jargon that keeps you up to date with the new-gen vocabulary. Learn with Pay10.