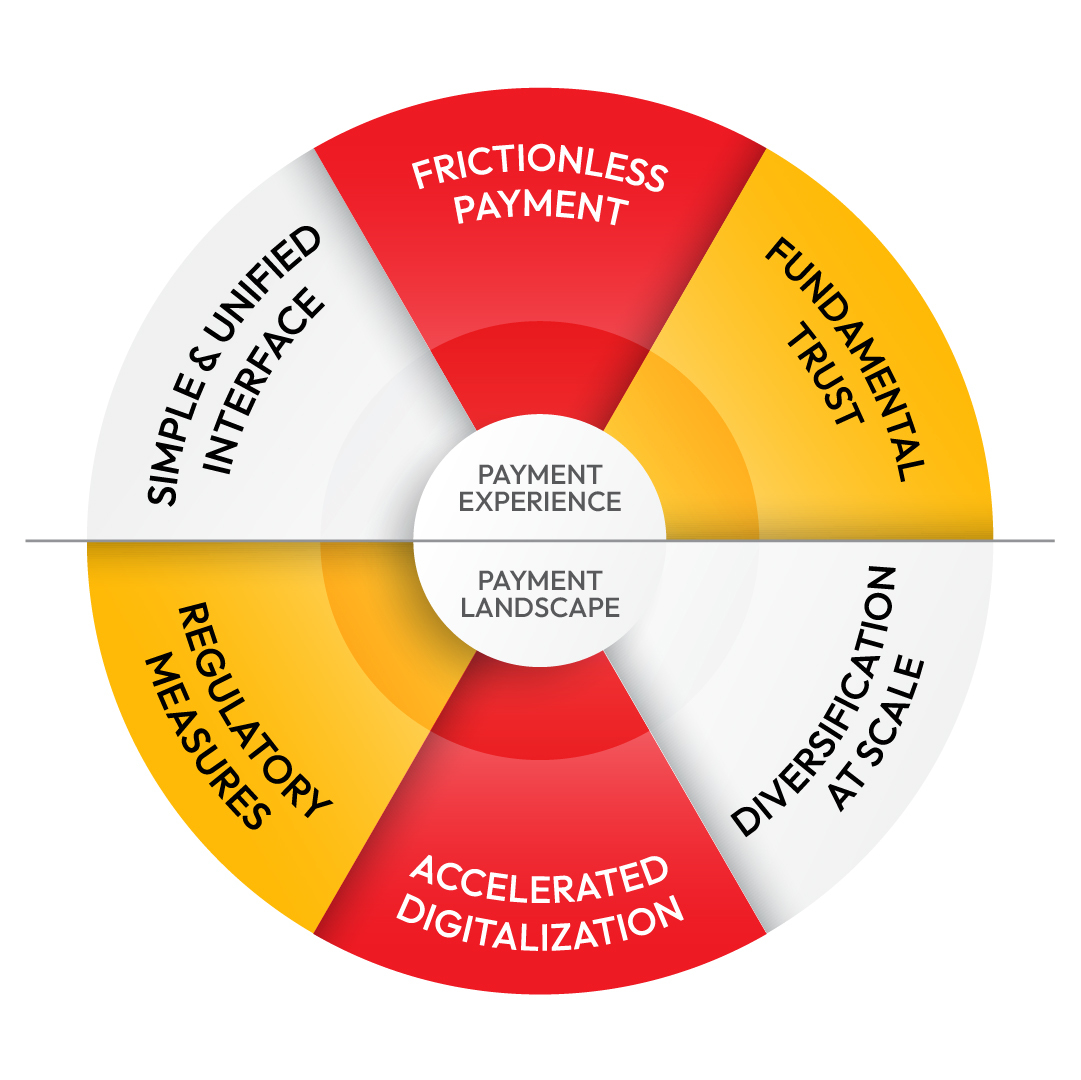

Factors influencing customer experience & confidence in Digital Payments

Customer Experience is the key point where the sedulousness of designing a product/service, marketing, and sales exercise culminates in impacting every performance indicator of a business. Payment experience is an essential element that falls under the ambit of Customer Experience. Previously defined by shorter and quick moving queues in brick & mortar stores to hosting a myriad of digital payment options in an increasingly cashless environment, the payment experience has become a complex ecosystem that needs to be quick, secure, seamless, and unified.

The transition from cash to digital payments was glacial at best with customer confidence in digital payments charting a slow progression. The Covid-19 pandemic was instrumental in accelerating the growth and innovation in digital payments. According to Statista, the total transaction value in Digital Payments Segment is projected to reach USD 160.60 bn in 2023. The customer confidence and experience with digital payments have increasingly been on the rise over the past few years. Here is a quick look at the major challenges faced by FinTech sector in catering to the evolving needs of a digital customer.

Challenge 1: Frictionless Payment

A smooth and seamless customer experience during the checkout process ensures a positive impact and adds positively to customer retention. The total range of customer expectations has expanded to cater to the varying needs of different demographics. Customer need for smooth, frictionless digital payment has metamorphosized into Autonomous Payments that facilitate payment transactions triggered by an authorized virtual payment agent on behalf of the consumer.

Solution 1: Accelerated Digitalization

Consumer trust is a hard-earned asset for businesses and the regulatory landscape acts as the foundation that helps build that trust. FinTech is a highly regulated industry focused on ensuring security, and seamless transactions driven by a futuristic outlook that serves the consumer’s best interests. Regulation landscape is constantly changing to accommodate new technological innovations and ensuring data security.

Challenge 2: Fundamental Trust

Consumer Trust is undeniably the coveted asset for any business irrespective of the sector or industry. With every new technological innovation, there are multiple data points collected and shared across different platforms to enable authentication, authorization, approvals, etc.

The primary consumer interest is security although simplicity of the payment process is desired. The implicit trust in payment service providers depends on several factors starting from on-time fulfillment of product/service by the merchant, timely processing of returns, refunds, and settlement, crisis response, and more.

Solution 2: Regulatory Measures

Consumer trust is a hard-earned asset for businesses and the regulatory landscape acts as the foundation that helps build that trust. FinTech is a highly regulated industry focused on ensuring security, and seamless transactions driven by a futuristic outlook that serves the consumer’s best interests. Regulation landscape is constantly changing to accommodate new technological innovations and ensuring data security.

Challenge 3: Simple & Unified Interface

With the increased internet penetration and digitalization there are numerous payment services available for consumers to choose from. The consumer expectation remains simple- they do not want to sign up on multiple platforms, consciously evaluate the right payment mode, or install different apps based on the merchant requirement. The consumer and merchants alike desire a single platform that unifies the diverse number of payment modes and options on a clean and user-friendly interface.

Solution 3: Diversification at Scale

The number of companies providing digital payment services are growing by the day with new innovations in the FinTech industry. With innovative technology and disruptive business models, the scale and scope for diversification of Payment Services are immense. The major challenge to boost customer confidence in digital payments is unification of services that involve multiple stakeholders. This challenge can be tackled only with increased collaboration and interoperability between different members of the Payment ecosystem.

The customer experience and confidence in digital payments lies in solving the dichotomy of challenges posited by the evolving consumer base and technology driven solutions implemented by the FinTech sector currently functions on a well-regulated medium. Pay10 is a Payment Service Provider offering a secure and seamless Payment Gateway that unifies diverse payment options such as credit/debit card, net banking, UPI, wallets and more