Digitisation has taken every industry by storm, and when it comes to FinTech, significant changes can be observed. The payment industry has been experiencing rapid changes over the years, and the growth is accredited to the two-edged purpose of being secure and customer-centricity. An exponential increase in the Fintech industry owing to rapid digitisation has contributed to the mushrooming of fraudsters, who are equally tech-savvy and outsmarting the most elite of the security systems. Digital fraud is the reality of the new media age, and the data is set to increase with the increasing internet penetration in India and around the world. Let's dive deeper into understanding the types and methods to counter digital payment fraud.

What is a Digital Payment Fraud?

Any false, or illegal transaction, that is executed with the foul intention of deceiving people, can be referred to as payment fraud. During the fraud execution, the perpetrator deprives the victim of funds, and sensitive information via unfair means. The increased number of electronic transactions has contributed to the increase in fraudulent activities.

Online Payment Fraud can be characterised in 3 Ways:

Most Common Digital Payment Fraud

There are multiple ways a swindler can deprive someone of their money, however, it completely depends on the prudence and meticulousness of the potential victim. Undeniably, any individual who is using online banking is a potential victim unless they fall prey to these hawk-eyed fraudsters who are waiting for one negligence. According to Juniper research merchant losses to online payment fraud will exceed $206 billion cumulatively for the period between 2021 and 2025. If you are hit by payment fraud, learn to get your money back using the below-mentioned instructions.

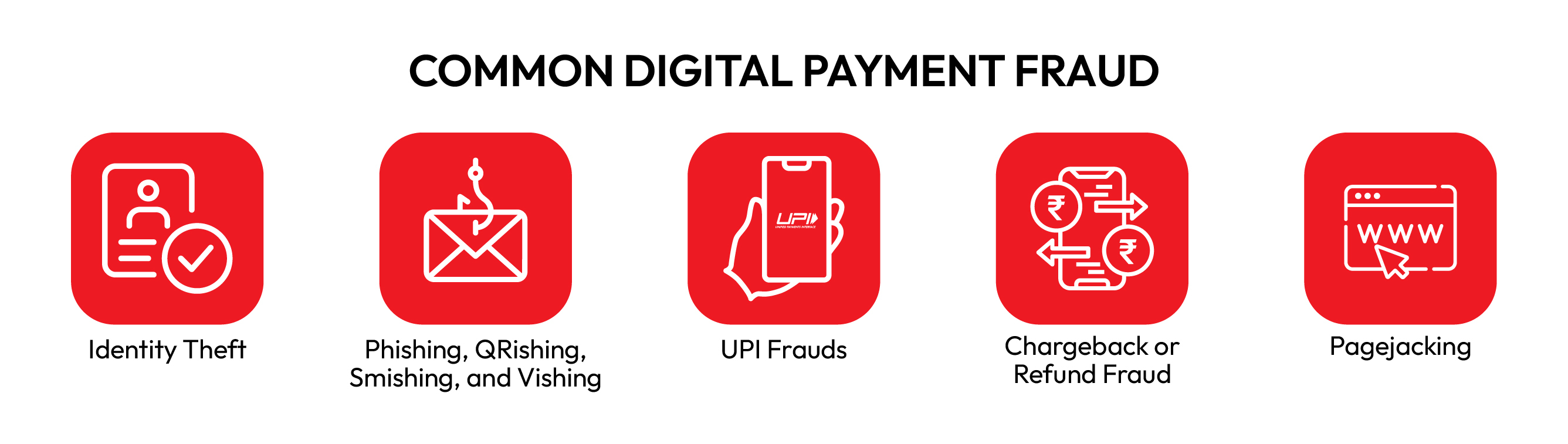

Common Digital Payment Fraud

Identity Theft Identity Theft Phishing, QRishing, Smishing, and Vishing UPI Frauds Chargeback or Refund Fraud Pagejacking

1. Identity Theft

Using false identity is the traditional modus operandi of creating a fake identity to commit criminal activities. Swindlers commit identity fraud by applying for credit under fake information and submitting for loans. There is a surge in the usage of advanced technology to impersonate individuals’ voices and features making it more difficult to verify authentic identity

2. Phishing, QRishing, Smishing, and Vishing

The traditional forms of fraudulent activities involve automated bots to impersonate businesses and connect with customers. Fraudsters use spoof websites, links, and SMS to convince unsuspecting victims and provide sensitive personal data

• Phishing: It is one of the most common forms of fraud, where scammers use a seemingly unreal email address with a link that asks for personal details such as full name, credit card number etc.

•QRishing: QR scams and phishing coalesce to form the term QRishing. It begins with scanning a malicious QR code, which redirects to a hidden URL promising the benefits of a coupon or voucher.

•Smishing: This form of scam uses text messages or common messaging apps. Generally, a scammed URL is attached to messages that ask for personal and banking details.

• Vishing:Just like phishing and Smishing, Vishing gives access to your personal information, but this method uses a phone call or voicemail to prompt users to expose private information

3. UPI Frauds

UPI, or Unified Payment Interface, is an instant payment system built over the IMPS structure enabling instant fund transfer between bank accounts. To secure the process, a unique 4–6-digit passcode is created during the registration process, known as UPI-Pin. Digital Payments in India took a huge leap with the introduction of UPI transactions however, fraudsters were quick in adapting ways to defraud consumers. UPI-related fraud is among the major concern in the Indian payment ecosystem.

4. Chargeback or Refund Fraud

In the earlier days, fraudsters used strategy conceptualisation, but with increased internet penetration, fraudsters impersonate authority professionals and offer fraud-as-a-service claiming to help consumers get their refunds. These fraudsters then deceive e-retailers by creating a rigged scenario with doctored images claiming refunds for receiving inappropriate orders.

5. Pagejacking

It is a process of illegally copying the content of a legitimate website through source code to a fraudulent website. These stolen pages are the near copies of original pages and the pagejackers siphon-off page traffic directly through search engines. Gradually the pages of fake websites are submitted to search engines, for duplicating page ranking. Pagejackers also mousetrap their targets by bombarding them with a never-ending supply of traffic-exchange banners and pay-per-click links with the objective of extracting maximum value from one-time visits.

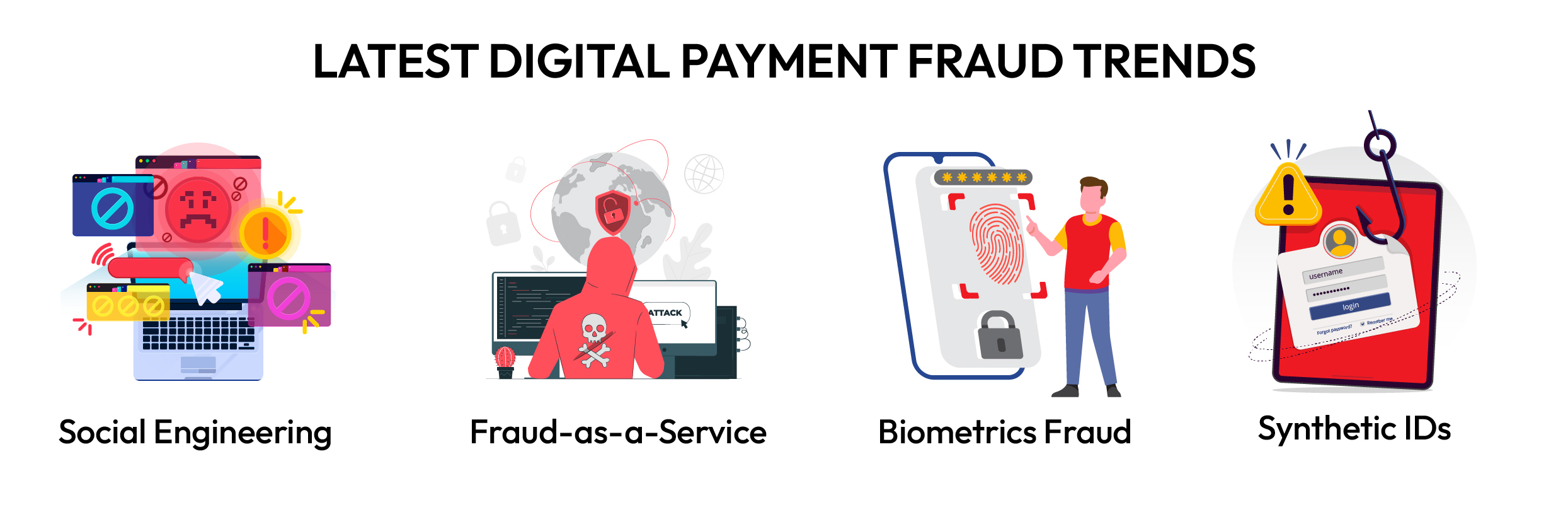

Banking Fraud Patterns & Trends in 2023

Financial fraud trends are spiralling by the numbers and there are many fraudulent activities to look out for in 2023. Paying through a secure PCI DSS-certified payment gateway with Transport Layer Security (TLS) feature to encrypt information exchange, shielding sensitive information reduces the chances of breaches. Here are a few payment frauds that depend on criminal cooperating.

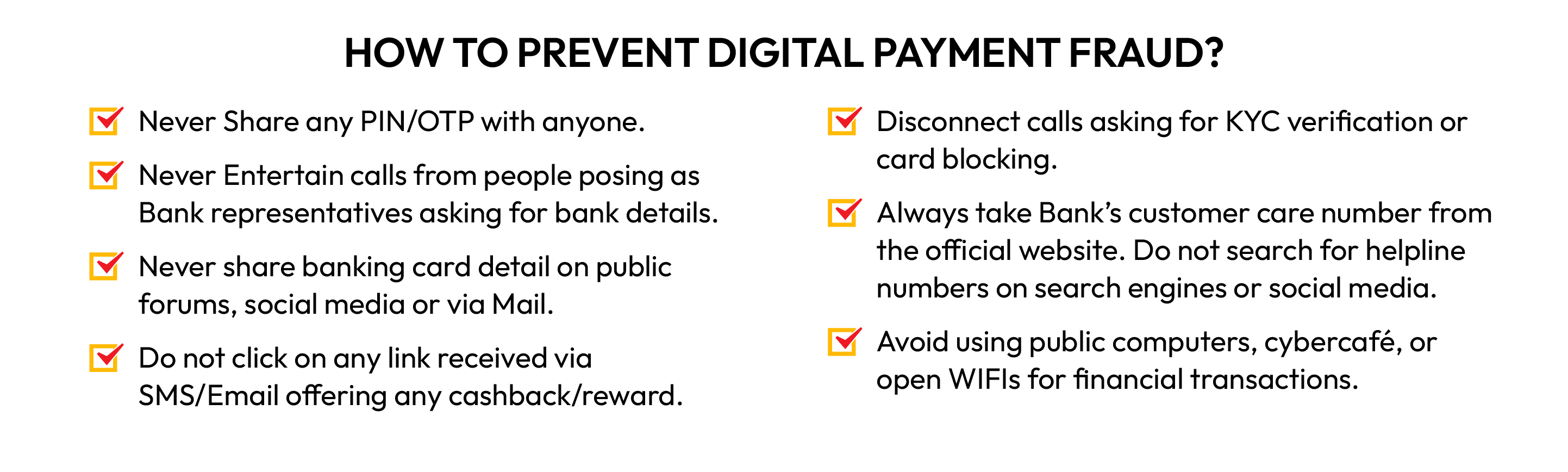

How to Prevent Digital Payment Fraud?

Besides the increasing adoption of digitisation, it is important to learn and understand the secure usage of online payment platforms. With India surging toward a robust cashless economy, it becomes and collective effort to ensure lesser loopholes and meticulous online transactions.

4 Steps to Follow, If You Are Hit by Online Payment Fraud

If you are hit by payment fraud, there are certain steps you must follow to get your money back. An immediate response can lead to a swift investigation process.

1. Inform Your Bank Immediately

Once you discover that you have been victimised by online transaction fraud, immediately contact your bank and ask them to take prompt action. Negligence can deprive you, of your hard-earned money. Raise a complaint to the bank authorities, and give them a detailed description of:

i. How did the fraudster connect with you?

ii. what was the conversation that you had (If it was a call/text)?

iii. Did you share any sensitive detail?

When a transaction is disputed as fraudulent, the issuing bank immediately issues provisional credit to the customer’s account and freezes the amount if it is still in transit and once the chargeback process gets completed, the provisional credit is made permanent.

2. Collect all the Pertinent Documents and Report the Fraud to the Authorities

Begin with recalling the entire scenario and creating a precise timeline. Collect all the pertinent documents and report the fraud to the local authorities for FIR investigation.

The details might include:

- Name/Times used by fraudsters.

- Email addresses and screenshots of emails interchanged

- Phone number(s) that were used to contact.

- Statements, trade confirmations, disclosures, and sales materials.

- Record of digital currency exchange.

- Record of other modes of payment used

- Correspondence received (if any)

3. Don’t Pay Any More Money!

Fee fraud has grown common these days, where fraudsters promise a large return to the victims in exchange for a smaller amount. After stealing the money in the first attempt, criminals further pretend to be calling from the victim’s bank or recovery agency. These recovery frauds target individuals that have been victimised recently and are in a vulnerable situation. The fraudsters claim to get the stolen money back if the victim pays the retainer amount. Usually, the perpetrators pose as government officials or agents from recovery companies. Do not entertain communication through incoming phone calls, emails, or SMS if you are under suspicion. Instead, meet the authorities in person or call them directly from your end.

4 Protect your Identity and Accounts

If somehow you have been tricked into sharing your banking details with the fraudsters, you must immediately block access to the account to protect yourself against identity theft and to counter digital payment fraud in 2023. In such situations connect with your banks and get your cards blocked as soon as you discover about your fraudulent transaction. Use strong and different passwords for all the accounts. Ensure that you do not share your personal and financial information over SMS or email, unless the requestor is credible. To prevent identity thefts, a credit freeze at credit bureaus in India is a crucial and helpful step. When a credit freeze is placed on the credit report, lenders are restricted from accessing credit information on frozen accounts. However, using a personal identification number (PIN) or password, the card owner can unfreeze the account anytime, if needed.

How Can Pay10 Payment Gateway Help?

Pay10 is an e-payments service provider, offering a suite of multiple products and services like a secure payment gateway, re-seller Services, e-payment wallets, bill payments, e-commerce services and online remittance amongst other things. As a reliable and converged payment solution provider, we prioritise our clients' data security, while catering to their distinctive needs.

With our efficient and affordable digital payment solutions, merchants and customers can enjoy a range of benefits, including quick payment processing, real-time reporting and analytics, besides enhanced security features to protect businesses from fraud and data breaches.

Pay10 online payment service provider uses advanced encryption and fraud detection technology to ensure that your transactions are processed securely and without any unauthorized access. We are fully compliant with industry standards, including PCI DSS ISO 9001:2015, SAR (PAPG & Data localization) and VSCC.

Frequently Asked Questions

- Q1. What is Payment Fraud?

- Payment fraud is any type of false or illegal transaction.

- Q2. What is Phishing?

- It is a fraud in which scammers use a seemingly unreal email address with a link that asks for personal and banking details.

- Q3. What is Synthetic Identity Theft?

- It is a financial fraud in which a real person's information, such as their Social Security number or date of birth is used to create a new fake identity.