EMV is a secure digital payment platform that is used worldwide, and it is managed by certain credit card issuers. EMV, which technically stands for Europay, Mastercard, and Visa, and it technically refers to the technology used in credit and debit cards that contain a microchip. These cards are designed to enhance the security of payment transactions and eliminate the risk of fraud. EMV cards use more dynamic authentication methods including a chip embedded in the card, than the traditional method of magnetic stripes. When an EMV card is used for transactions, the chip generates a unique code for each transaction making it difficult for fraudsters to counterfeit the card. The EMV technology introduced the use of PINS as an additional layer of verification, adding another level of security to transactions. The Chip and PIN system has become the standard in many countries worldwide.

Key Components of Technology Behind EMV Payment Processing?

The technology behind EMV payment processing primarily revolves around the use of embedded microchips, secure algorithms, and cryptographic functions. Let’s understand the breakdown of its key components:

1. EMV Chip: The main component responsible for the success of EMV cards is the small, embedded microchip that is also referred to as an EMV chip or smart card. These chips have the primary purpose of storing and processing data securely.

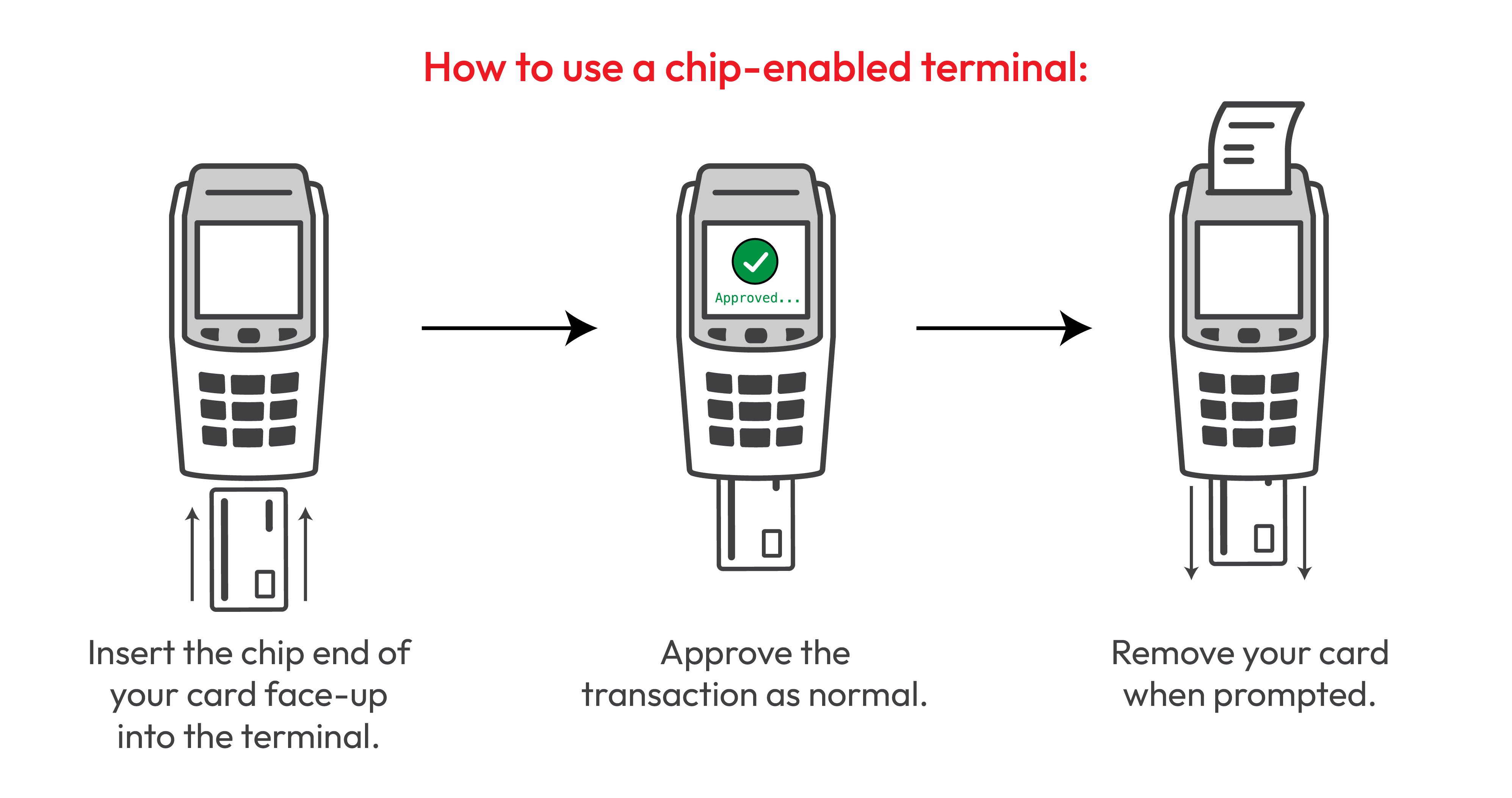

2. Terminal Communication: When a transaction commences, the EMV communicated with the payment terminal using the process, generally known as "chip and terminal communication.” The communication subsequently exchanges data and commands to authenticate the card and verify the transactions.

3. Cryptographic Functions: Europay, Mastercard, and Visa cards optimise cryptographic functions to protect sensitive data during these transactions. It encrypts the data, shielding it from the unauthorised parties often setting fraud traps to deceive people of their money.

4. PIN Verification: EMV cards are the more secure ways to make digital payments, as these cards often require cardholders to enter PIN for an additional layer of verification. PIN or Personal Identification Number, combined with the chip data, provides an added layer of security and resultantly prevents unauthorised usage of the card.

5. Card Authentication Methods: EMV technology stands with numerable card authentication methods, for instance, offline data authentication (ODA) and verification methods such as (SDA/DDA/CDA). These methods make sure that the card being used is genuine and not tempered.

Combining these technologies and protocols makes EMV payment processing more secure than traditional magnetic stripe cards, reducing the risk of fraud and providing enhanced protection for cardholders and merchants.

How EMV Enhances Your Business’s Payment Processing?

EMV is a technology that significantly impacts a business’s bottom line. Here are a few prominent advantages that can be attained by using EMV technology. Implementing EMV technology in your business's payment processing can provide several key benefits and enhance your overall payment security:

- Fraud Reduction: The dynamic authentication and encryption processes make it extremely difficult for fraudsters to replicate the card or obtain sensitive card data. Thus, EMV reduces the risk of card-present fraud, such as counterfeit cards or cloned cards.

- Chargeback Reduction: Chargebacks can be costly and time-consuming for businesses. EMV technology helps mitigate chargeback risks associated with counterfeit or stolen cards. If a transaction is verified with a chip and PIN or chip and signature, it can provide stronger evidence in case of disputes, reducing the likelihood of chargebacks.

- International Compatibility: EMV is a global standard, widely accepted in many countries. By implementing EMV technology, a business ensures compatibility with international payment systems and caters to customers who are accustomed to using chip-enabled cards.

- Future-Proofing: As payment technology continues to evolve, EMV provides a foundation for incorporating additional payment methods, such as contactless payments and mobile wallets. EMV-enabled terminals often support these emerging payment options, allowing businesses to adapt to changing preferences of their consumer.

- Compliance with Payment Industry Standards: Many payment industry regulations and standards encourage or require EMV adoption for improved security. EMV technology aligns business with industry best practices and maintains compliance with these standards.

How to Integrate EMV Transactions in Business?

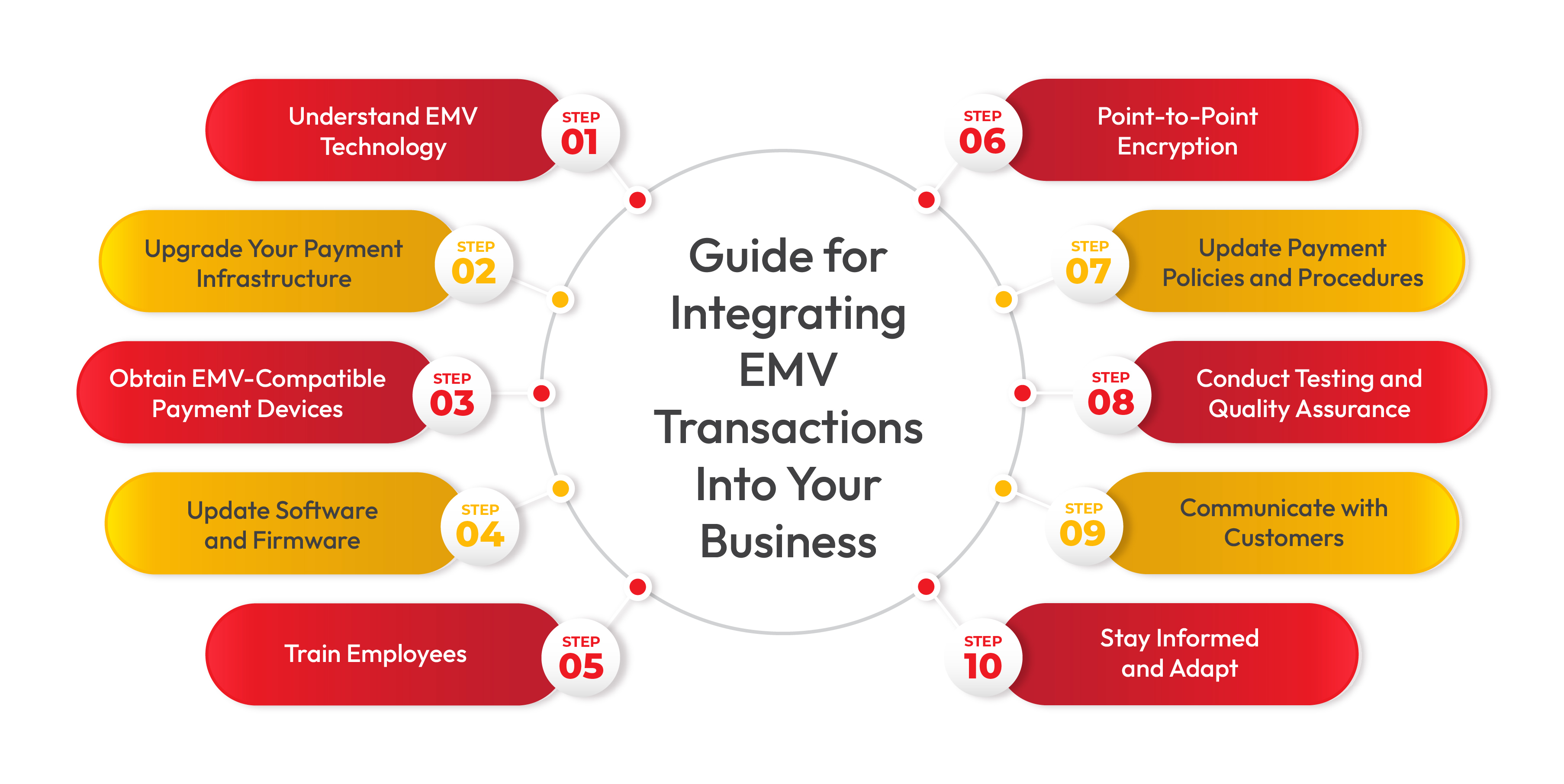

Integrating EMV (Europay, Mastercard, and Visa) transactions into business is an important step for enhanced security and reducing the risk of fraudulent activity. Let’s dig deeper into the general guide for integrating EMV transactions into your business:

Integrating EMV payment processes into your business is a crucial step towards enhancing security and protecting both your customers and your business from fraudulent activities. By adopting EMV-compliant hardware, updating software, and training your staff, you can provide a safer payment environment that aligns with industry standards. EMV transactions not only offer enhanced security through chip-enabled cards but also help build trust with your customers by demonstrating your commitment to safeguarding their sensitive information. Embrace the power of EMV, and reap the benefits of a more secure and resilient payment ecosystem. For more information about the topic or about the digital payment platform, feel free to contact us.

Pay10 is an innovative service provider, and we intend to empower businesses of every sector and scale with easy and accessible digital payment solutions to give you an extra edge.Our services include a secure payment gateway, e-payment wallets, e-commerce services, online remittance, and merchant accounts.

FAQ

- Q1. What is EMV?

EMV is an Integrated Circuit Card Specifications for payment systems. EMV helps to facilitate

interoperability between chip cards and terminals for both credit and debit transactions.

EMV is also known as Chip Cards, Smart Cards, or Chip and PIN.

- Q2. What are the features of the Chip?

When an EMV card is used for transactions, the chip generates a unique code for each

transaction making it difficult for fraudsters to counterfeit the card. The EMV technology

introduced the use of PINS as an additional layer of verification, adding another level of

security to transactions. These chips also store and process data securely.

- Q3. What is a dual-interface card?

A dual-interface card supports both contact (via the chip plate on the front of the card)

and contactless transaction processing via an embedded antenna and transmitter.