Who would have imagined making payments with a simple “abracadabra”? Contactless payment seems no less than wizardry, that you can secure in your wallet. Over the years, fast-paced advancements have revolutionised the payment methodology. The introduction of contactless credit cards is one such innovation that has taken over the world by storm with a seamless and secure payment experience. But what exactly are contactless credit cards, and how do they work? Read on to learn about them, their benefits, their functionality, and how they are transforming how we pay.

What is Contactless Credit Card?

A contactless credit card, best known as a Tap-&-Go card, is a type of payment instrument that uses near-field communication (NFC) technology to enable quick and secure transactions without any physical contact with the card reader. This type of card possesses built-in chips that communicate with the payment terminal when held in proximity. The card and the terminal communicate wirelessly, by exchanging necessary and required details to authorise payment. The payment processes are faster as compared to the traditional method that requires a pin or swiping. Contactless cards are widely accepted by merchants across verticals. However, the subsequent limit varies depending on the country and bank.

How Do Contactless Credit Card Payments Work?

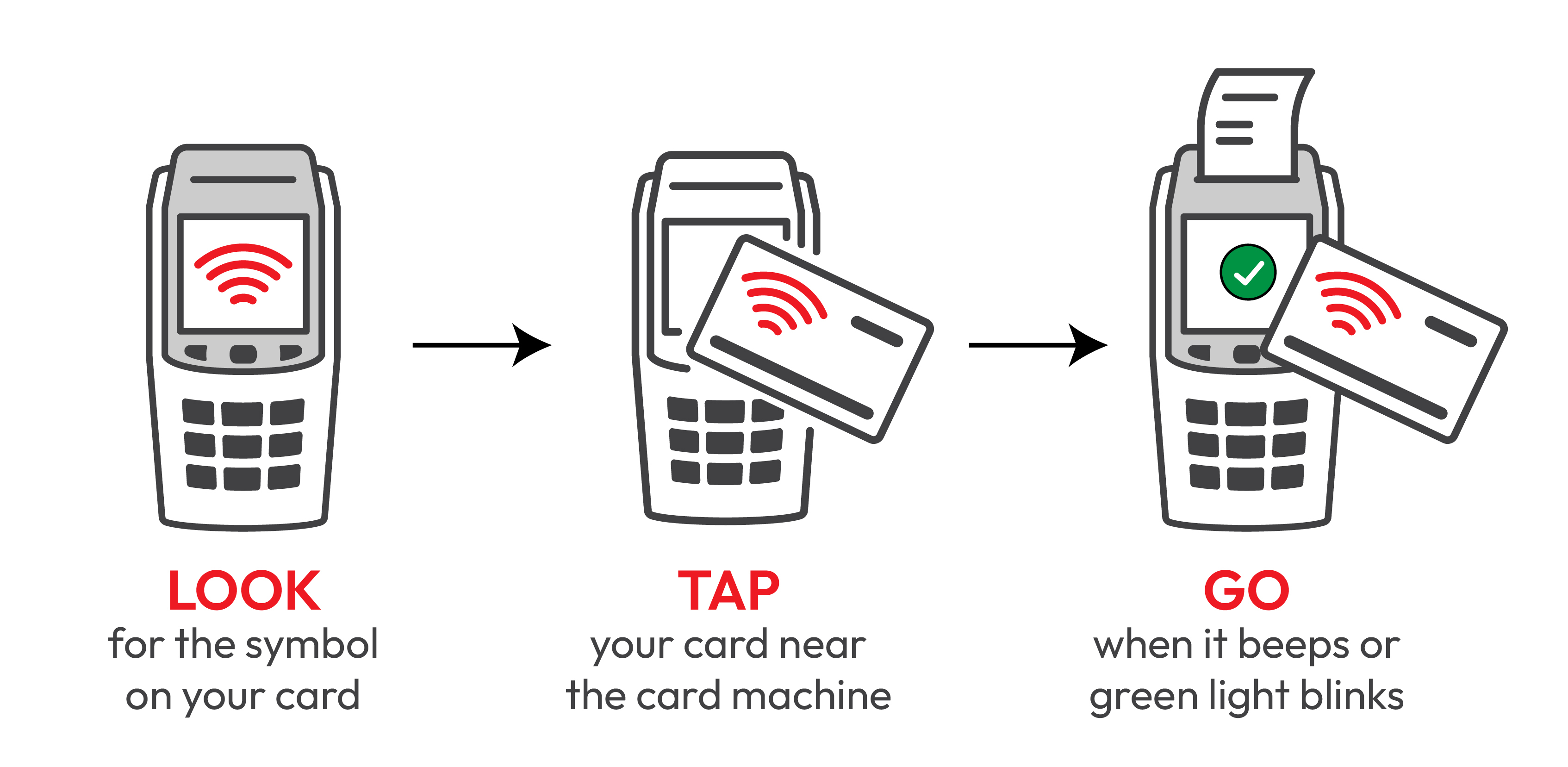

Tap-and-go cards use near-field communication technology. There is a very easy way through which a cardholder can recognise if the card can be used for contactless payment. These cards typically have a contactless symbol (WIFI symbol) on the front and back of the card. These cards have a relatively low to enhanced amount of security. Additional security measures, such as PIN verification or inserting the card into the terminal, may be required for higher-value transactions.

Here are a few steps that are followed for executing contactless payments.

1. Card Initialization: When a card holder receives a contactless card, it comes with inbuilt NFC chip. The card gets activated post receipts from the financial institutions. Merchants accepting contactless payments have payment terminals equipped with NFC compatibilities.

2. Payment Initiation: Payment transaction with contactless credit cards is easier than the traditional card payments. The card needs to be placed at few centimetres or almost an inch unhindered communication. If applicable the card may as the holder to select payment option(debit/Credit).

3. Transaction Authorisation: As cards are places in proximity with the terminal, the NFC built in card emits radio frequency signals that is further detected by terminals. This signal established a secure communication channel between card and terminal. Post that the exchange of encrypted information happens through a secure network.

4. Payment Confirmation: During the transaction authorisation process, once all the information including card’s unique identifier and transaction amount is exchanged, the payment terminal verifies the data and check for sufficient funds. Post the successful authorisation, the terminal confirms the transaction, and the payer receives the confirmation message.

5. Transaction Completion: It is the last and final step of the entire contactless payment transaction. Post the authorisation of payment, and confirmation of transaction, the payment amount is deducted from payer’s credit card balance or linked bank account. Entire process of transactions takes place within seconds. Contactless credit card payments are designed to be quick and convenient, reducing the need for physical contact or the insertion of the card into the payment terminal.

How To Use Contactless Credit Card in India?

Contactless credit card in India is quite common and the usage is quite prevalent, but there are few requisites that are to be taken care while making a payment. It is extremely important to check for the contactless symbol on the credit card. It is a WIFI symbol indicating the feature activation.

The payers must verify that the merchant, that they are willing to pay accepts contactless payment. These days many retailers, seller, restaurants, and other business install contactless enabled payment terminals. The payer must approach towards the payment terminals and verify the amount on the display screen of on the payment terminal and follow the steps.

Once the payment is processed, the payment terminal will auto detect the card and will establish secure connection. When the transaction will get authorised, the payer will receive a message confirming the payment. The payer may also hear a beep or see a light indicator indicating a successful payment.

How to Protect your Contactless Credit Card?

Contactless payment fraud continues to rise with the rapid adoption of payment digitisation. Here are a few steps that can be followed to keep contactless cards safe.

1. Keep Your Card Protected: Since it is very convenient to make payments through, Tap and Go cards fraudulent activities too can be easily executed. Make sure that your card doesn’t fall in wrong hands. Make sure that you do not leave your car unattended or at an easily accessible place.

2. Activate Your Card Security: Mostly contactless cards come with additional security feature which is provided by the card issuer. These features can be utilised to ensure the safety of cards. Few of the example of these features are transaction notification, spending limit etc.

3. Protection against RFID Skimming: It is a fraudulent activity and a form of digital theft where swindlers attempt to wirelessly capture card’s information. To protect against the fraud card holder needs to activate RFID-blocking sleeve or wallet to shield their card when not in use. The main function of RFID-blocking sleeve is to prevent unauthorised scanning of contactless cards.

4. Keep a Track on Your Transaction: Keep an eye on the money spend and especially the notification that you receive from your card provider. In-case of any suspicious transaction connect with your card issuer or get the card blocked immediately.

5. Create a Strong PIN & Enable 2F Authentication: It is important to create a strong PIN which is not easy to guess. If you have a contactless credit card linked to mobile wallet, it is recommended to enable two-factor authentication for an added layer of security. It typically involves a combination of passwords and biometrics (fingerprint/face recognition) for authenticating transactions.

In the ever-evolving world of financial technology, contactless credit cards have emerged as a revolutionary payment solution, transforming the way we conduct transactions. Offering a seamless, fast, and secure experience, these cards have swiftly gained popularity among consumers and businesses worldwide. If you are a budding entrepreneur, and looking for a secure payment gateway, we are right here. Pay10 is a payment gateway that fosters secure payment transactions, we are compliant with PCI-DSS Level 1, SAR (PAPG & Data localization) and VSCC, ISO 9001:2015, 27001:2013 certifications. While the servers are hosted by reliable cloud service providers (AWS- Amazon Web Services) offering unparalleled data security. Start your payment journey with us now.