What are Multiple Payment Gateways? How do you benefit from them?

The world of finance is no stranger to rapidly evolving technology. If we drop a dime in our piggy bank every time a new technological innovation hits the market, we will need a houseful of piggy banks. Do we need to invest in every shiny new dime that gets pitched in the market? Now that you know the answer to what is payment gateway? We can move on to learn about multiple payment gateways and understand the pros and cons of using them. So, by the end of this read you will be able to make an informed decision on whether your business needs to invest in owning Multiple Payment Gateway services. Let’s begin with understanding the customer’s perspective of a purchase.

Single payment gateway Vs Multiple payment gateways.?

In simple terms, when a customer decides to buy a product or a service online, it starts with adding the item to a cart followed by a check out. When they hit the check out, they land on a page that says, ‘Preferred Payment Mode.’ The options available on this page can either be a single mode of payment that asks you to enter your Credit Card details or a sophisticated page with multiple payment options like Debit/Credit Card, UPI, Wallets, Net Banking and more. All the customer expects is a simple click and pay that leads to a hassle-free and secure transaction.

Does your business need Multiple Payment Gateways?

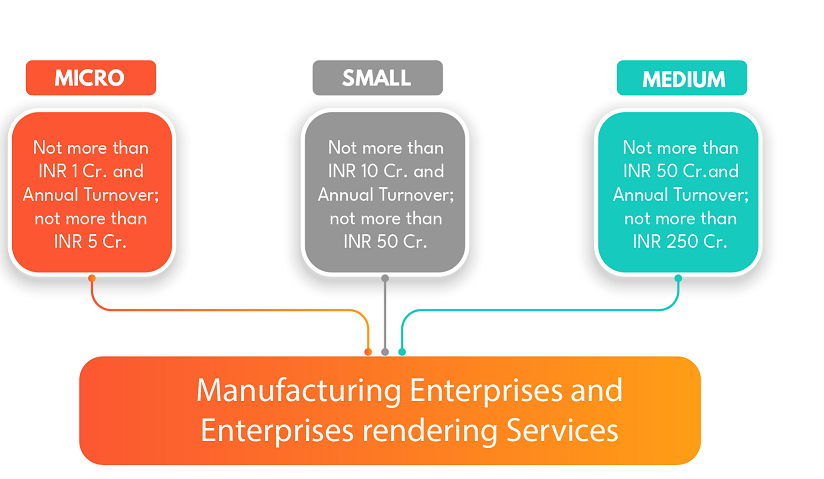

Yes. Multiple Payment Gateways offer the luxury of choice that acts as a reliable fail-safe for outages. In business & finance, quite unfortunately, one size does NOT fit all. So, find out what is the scale of your business? From July 1, 2020, Government of India has implemented the new categorization of MSMEs in India based on an upward revision in the definition and criteria. It applies to entities in both manufacturing and service sectors:

Now that you have figured out the category of scale and operations of your business. You understand the scalability of your business with international outreach depends on access to your product/service, reliability, and other variables.

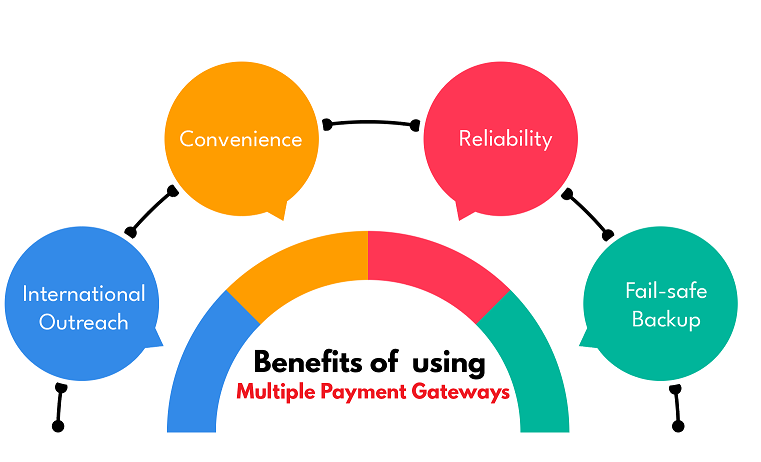

While ease of access has several influencing factors; the use of Multiple Payment Gateways will help positively impact global business outreach. Here are 3 ways the use of multiple payment gateways benefits your business.

The shift to FinTech

The unprecedented shift towards advancing FinTech is the certain way forward. According to the 2022 Q2 Report of Inc42., there is 61% Internet penetration in India, the financial world has been quick to adopt digital payments that has streamlined most the previously underbanked business sectors in the market. As of May 2022, the total value of UPI transaction is estimated to be $2 Trillion. The anticipated increase in percentage of internet users from 2022 to 2030 is 44%. The numbers alone stand testament to the great transition of the world of finance from traditional banking to innovative & intuitive FinTech.

Role of Payment Gateways

The expectation of the customer during a purchase begins and ends with just two factors – ease and security. Multiple payments gateways ensure ease of choice. According to STATISTA, 30% of the customers showed increased interest in purchasing a product/service online enabled by an easy check out process. A Single Payment Gateway requires the customer to reach for a Credit Card and enter the details. Whereas Multiple Payment Gateways plays a crucial role in the checkout process. The luxury of choice – Payment Methods, when making a payment nudges the customer to pay for the product/service.

How to make a customer purchase?

Choice is no longer a luxury for a select few, it has become a necessity for all. In the current market scenario, every product/service has limitless competitors. According to a study conducted by Baymard Institute, about 17% of customers abandon their carts because of longer check out process and another 9% due to unavailability of enough payment methods. If enticing customer interest to look at your product/service is a task, coercing them to click ‘Pay’ requires substantial amount of choice and an added reliability factor that facilitates the customer to make the purchase.

Now that you have learnt the basics of how digital payments work and the benefits of Multiple Payment Gateways. Pay10 offers a whole repertoire of secure digital payment services that enable your business to have Multiple Payment Gateways and provides secure FinTech Solutions to every business need. Contact us to avail personalized FinTech Services.