What is a Digital Wallet?

Digital Wallet is the most popular form of Prepaid Payment Instrument (PPI) used in India. Also referred to as an e-wallet, the digital wallet is an easy way to carry cash in digital format. It is generally a software application or electronic device that securely stores payment information and prepaid money. The increased mobility offers several added advantages to the consumers in the new digital age that is fuelled by FinTech innovations for driving a cashless economy.

Digital Wallet is convenient & a versatile option for making payments with just a wave or tap of the smart phone in brick & mortar stores, for online purchases, or via a mobile application. According to Statista , the volume of mobile wallet transactions experienced a significant increase from 32.7 million transactions in fiscal year 2013 to about 4 billion in fiscal year 2021. Let us understand the significance and added advantages offered by Digital Wallets for businesses.

How to use a Digital wallet?

All that you need for accessing the Digital Wallet is a Smart Phone with an internet connection. It is mandated by the RBI (Reserve Bank of India) to collect KYC (Know Your Customer) information in order to gain access to Digital Wallet services offered by banks and third-party applications. E-Wallet or Digital Wallet offers the following convenient and accessible services to the consumer as listed below:

1. Balance Enquiry

2. Transaction History

3. Add, Accept, & Pay money.

For Aadhaar-based KYC the end user needs to complete a Full KYC process that includes PAN Card or Aadhaar Card verification along with a biometric verification and other additional information as listed in the guidelines set by CERSAI (Central Registry of Securitisation Asset Reconstruction and Security Interest of India) and RBI. While Full KYC Wallets offer several additional features and benefits, Minimum-KYC Wallets (it only requires a Unique Identification Number & Full Name) offers partial access to the same by limiting certain features.

Are Digital Wallets Safe?

Digital Wallets are generally a mobile application that is installed in a password protected smart phone. The Payment Applications are secured with advanced encryption to protect the payment information stored within them. Also, the digital wallets have several key security features such as 2-factor authentication, OTPs (One-time Passwords), that can be used if required.

Consumer Wallet & its Benefits

Digital Wallet offers multiple benefits for the end-user i.e., the consumer. Here are few major advantages listed below.

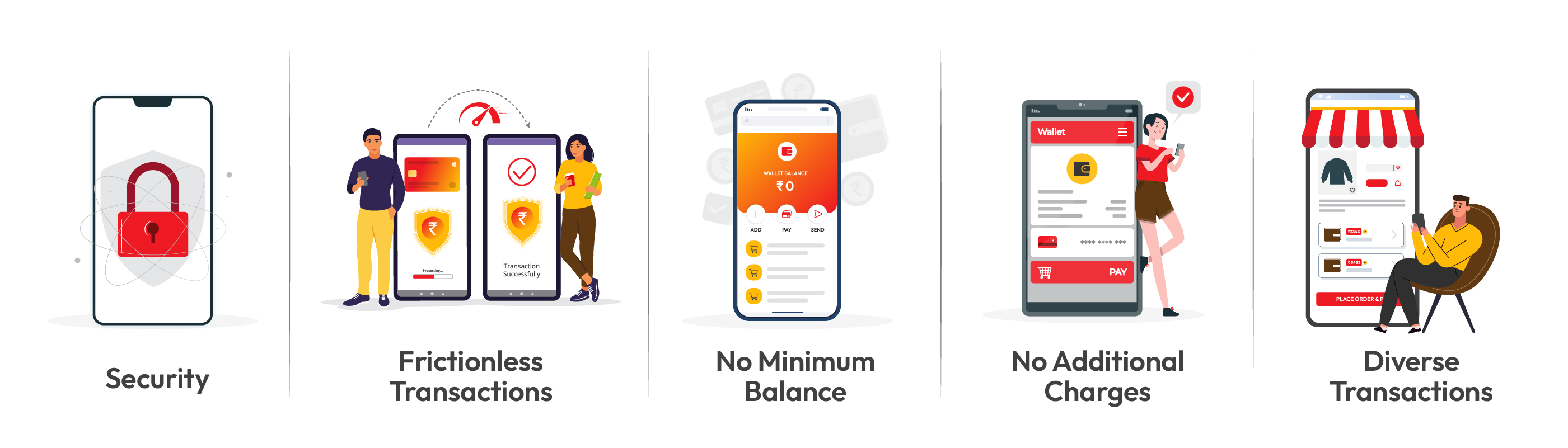

1. Security- Digital Wallets often require biometric authentication to access the payment information while the money remains safe in an encrypted software application that is installed in a password-protected smart device

2. Frictionless Transactions- Digital Wallets enable quick transactions with simple, user-friendly UX and lesser steps to authenticate and complete a transaction.

3. No minimum balance- Popular Digital Wallets require no minimum balance to maintain and access its services. Depending upon the KYC verification, consumers or end users can save as much or as little as they prefer.

4. No Additional Charges- Popular Digital Wallets available in the marketplace is currently free to use with Zero additional charges.

5. Diverse Transactions- Wallets can access diverse transactions from a single app- from paying bills to completing an e-commerce purchase online.

Merchant Wallet & its Business Benefits

Similar to the consumer wallet, Merchant Wallets aid in payment transactions from customers and have a few more functionalities that is beneficial to merchants. The Digital Wallet, for both- single and multi-merchant accounts, offer many integrated options like loyalty programs, geolocation, product recommendations, etc. This helps ease the customer journey to be more fluid and transparent. Here are few ways Merchant Wallet improves user experience.

1. Switch between cash and digital payments is made easy, convenient, and accessible for customers.

2. Accept payments from other wallets and bank accounts without sharing personal information.

3. Improved security protection to safeguard payment information and transactions.

4. Frictionless payment experience contributes to higher success rate and reduced churn rate.

For Merchants- Digital Wallet Vs Payment Gateway

While Merchant Wallet offers many benefits for businesses, it is a compounded entity that relies on digital certificates that authenticates the identity using system, device, and application. Whereas Payment Gateway is offered by Payment Service Providers that allows users to choose their payment mode and authenticate their financial details to approve a payment with multiple layers of enhanced security features.

The rise of digital payments in the country necessitates merchants to have secure and competent systems in place to accept and process digital payments. Payment Gateway offers an end-to-end automated solution for all the payment requirements.Pay10 Payment Gateway unifies several payment options like credit/debit card, net banking, UPI (Unified Payments Interface), wallets, Payment Links, and more and provides merchants with access to a fully analytical dashboard and top-of-the-line security features.

Pay10 Payment Gateway with easy and hassle-free merchant onboarding. We also provide top-of-the-line security features, support a whole array of different payment modes, and a fully analytical dashboard; Payment Links, Billing service, Reseller services, Payout services, and more.