Digital Payments- Security features that you need.

Digital Payments or e-payments are transactions that take place online via digital modes without any exchange of hard cash. In this case, both payer and the payee use electronic medium to transfer money. Technology has brought us a long way- we just point and click to make a payment that gets processed in a matter of seconds. According to Statista, total transaction value in the Digital Payments segment is projected to reach USD 133.40 bn in 2022. It is deemed mandatory for any system handling digital payments to be prudent and employ certain regulations and processes to protect the interests of all parties involved.

Although this might seem like a digital utopia, it comes with its own set of challenges. Rendering statistics from a National Survey conducted by LocalCircles, 42% of Indians have faced financial fraudand 74% could not retrieve their money. There are new security measures put in place, the customers are advised by all entities to be alert when performing transactions and keeping oneself informed of fraudulent pursuits and the security measures employed by the parties involved in processing your transactions. Here are 4 fundamental but critical security measures that Payment Service Providers offer to ensure secure financial transactions.

- Certification- PCI DSS/PCI SSC

- Certification- SSL/TLS

- 3-D Secure 2.0

- Data Encryption

Payment Card Industry Data Security Standard (PCI-DSS) or Payment Card Industry Security Standards Council (PCI-SSC) are a set of security standards formed by Card Service Providers such as Visa, MasterCard, etc. While the certification entity does not have any legal authority to compel compliance, it is a requirement for any business that processes credit or debit card transactions.

How does the PCI certification help?PCI compliance indicates that the systems handling the payment are secure and customers can trust the system with sensitive information such as credit/debit card details. It prevents security breaches and data theft with efficient IT infrastructure. Complying with PCI certification makes the system better prepared to acquire HIPAA, SOX, and others.

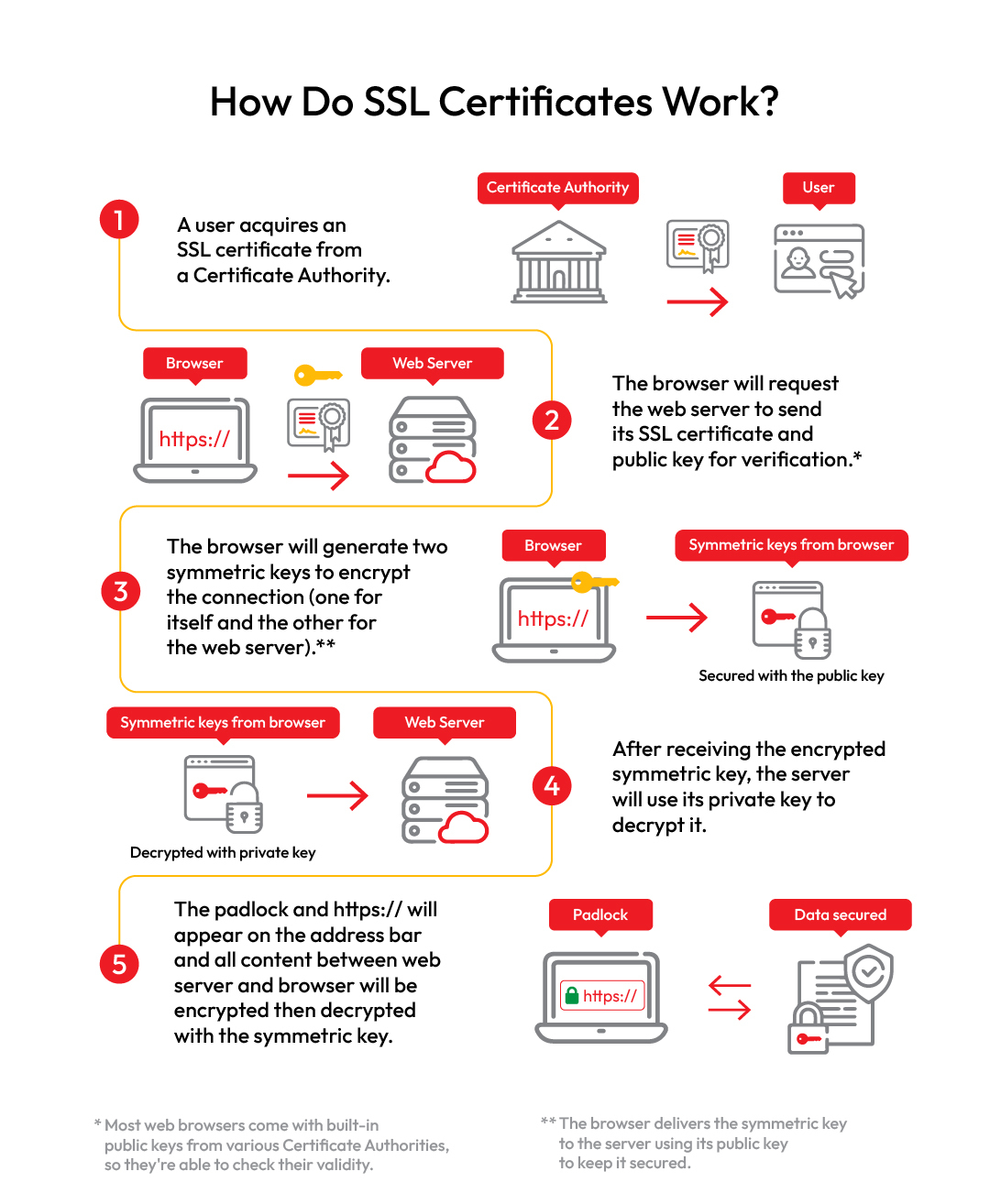

Security Socket Layer (SSL) or Transport Layer Security (TLS) certificate binds the identity of a website to a cryptographic key pair consisting of a public key and a private key. The public key allows a web browser to initiate an encrypted communication session with a web server via TLS and HTTPS protocols. The private key is kept secure on the server and is used to digitally sign web pages and documents.

How does SSL/TLS Certification help?SSL/TLS Certification ensures protection of sensitive information such as usernames, passwords, or payment processing information. The main intent of the certification is to ensure only one person or organization- can access the data that is transferred, thereby preserving authenticity of the information. It is necessary to comply with current PCI guidelines.

Strong Customer Authentication (SCA) is an authentication data connection between digital merchants, payment networks, and financial institutions. 3-D Secure 2.0 is the latest version that enables a real-time, secure, information-sharing pipeline. It can be used to send an unprecedented number of transaction attributes that the issuer can use to authenticate customers more accurately eliminating the need for static password.

How does 3-D Secure 2.0 help?3-D Secure 2.0 is a user-friendly solution that enables seamless purchase experience. It provides an added layer of security for online transactions. The frictionless authentication without any additional input from the customer. It also helps improve internal risk procedures to assess and score each transaction in real-time.

Protection of financial data while in-house and in-transit is essential. In data encryption, the data is encoded with the help of complex mathematical algorithms. The encoded data can be accessed only with the correct decryption key. Encoded data is useless to hackers without the correct decryption key. There have been several different data encryption algorithms developed and used over the years like: TripleDES, AES, RSA, Twofish, Blowfish, and so on.

How does data encryption help?There a several ways a code can be secured. Data Encryption depends upon the architecture of the FinTech app. Data input validation, authentication, managing passwords, cryptography practices, handling errors and logging, protecting data, and secured communication are the fundamentals used to develop a secure code that reduces the software vulnerabilities that hackers try to exploit.

Pay10 is a secure payment solutions provider with a Secure Payment Gateway with PCI-DSS Level 1 certification, ISO 9001:2015, 27001:2013, servers hosted by reliable cloud service provider (AWS- Amazon Web Services) offering unparalleled data security, server uses Comodo’s 256-bit SSL technology for data encryption, and strict in-house security guidelines that ensure confidentiality of payment information.

To know more, contact our Pay10 team to avail payment services starting from Payment Links, Re-seller services, e-payment wallets, e-commerce services, online remittance, PoS (Point of Sale) Terminal, merchant account, and secure Payment Gateway.