E-commerce has revolutionised the way we make a purchase, and payments have been an integral part of the e-commerce journey. As every year the number of online buyers increases the necessity of a robust and reliable eCommerce payment gateway becomes more significant. The emergence of payment platforms has not been strange to the world, as a new platform is introduced with every drop of a dime in our piggy bank. The question arises as to which is the best and most reliable payment gateway that adds to the merchant’s journey and consumer touchpoints. Let’s dive deeper to understand the future of e-commerce platforms concerning innovation and technology.

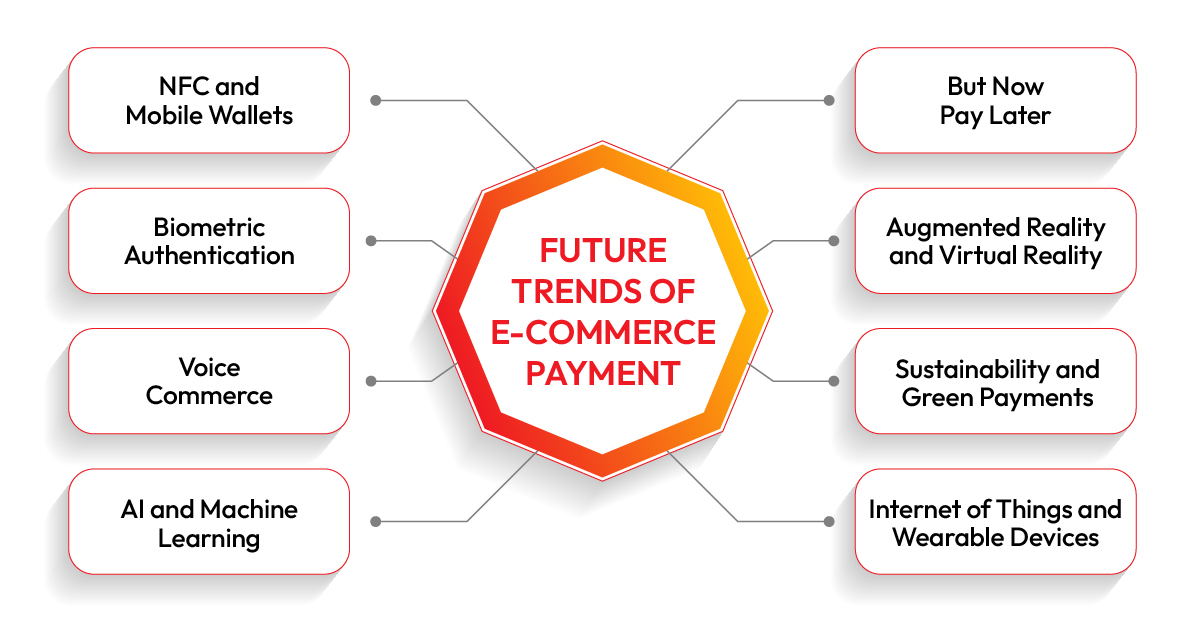

Innovation has reached a specified tangent when it comes to the evolution of digital payments. Here is a list of certain e-commerce payment trends that are reshaping the entire experience of the selling and buying journey.

NFC And Mobile Wallets as Futuristic Innovation

NFC Payment methods continue to gain popularity due to their convenience and security. Contactless payments epitomize the future of ecommerce transactions, offering seamless, secure, and swift transactions. By leveraging near-field communication (NFC) and mobile wallets, this technology ensures convenience, reducing physical contact and enhancing user experience. With the proliferation of smartphones and wearables, consumers increasingly prefer this frictionless method, fostering a shift away from traditional card-based transactions and heralding a future where speed, ease, and safety converge in the realm of digital transactions.

Biometric Authentication as Innovative Technology

Biometric authentication stands at the forefront of the future in e-commerce payments, revolutionizing security and user experience. Incorporating unique biological markers like fingerprints, facial recognition, or iris scans, ensures highly secure and convenient transactions. This technology mitigates the risks associated with traditional password-based systems, providing a seamless and personalized payment process while promising a future where users can securely authorize transactions with a touch or glance. Biometric authentication in digital payment emerges as the linchpin for a safer, user-centric, and technologically advanced e-commerce payment ecosystem.

Voice Commerce the Future of eCommerce Payments

Voice commerce represents the cutting-edge future of ecommerce payments, that contributes to evolving the methods of transactions through seamless voice-enabled interactions. With advancements in natural language processing and AI, users can effortlessly browse, select, and authorize purchases using voice commands. Voice commerce's potential lies in its ability to redefine the shopping landscape, offering a personalized, efficient, and intuitive means of conducting e-commerce transactions, marking a paradigm shift toward a more interconnected and effortless payment ecosystem.

AI and Machine Learning in Indian eCommerce Landscape

AI and machine learning are the cornerstones of the future in e-commerce payments, offering unparalleled capabilities for personalization, fraud detection, and optimization. Through data analysis, these technologies predict consumer behaviour, tailoring shopping experiences and suggesting personalized offerings. They bolster security by swiftly detecting and preventing fraudulent transactions, ensuring trust and safety. Moreover, in the best payment gateway in India , the AI-driven algorithms refine payment processes, optimizing efficiency and reducing errors. This dynamic duo's integration into e-commerce payments heralds an era of smarter, data-driven decision-making.

Buy Now and Pay Later Popular Trend in FinTech

According to the Global Payments Report 2023 by Worldpay from FIS, BNPL’s global e-commerce transaction value is projected to grow at 16% CAGR from 2022-2026. Buy Now, Pay Later" (BNPL) represents the innovative future of e-Commerce transactions, offering consumers the flexibility to acquire goods immediately while spreading payments over time. This payment model eliminates upfront costs, attracting a wider audience and enhancing purchasing power. By integrating seamlessly into online payment system, BNPL solutions simplify checkout processes, boosting conversion rates for merchants. However, prudent consumer education and responsible lending practices remain crucial to mitigate potential debt concerns.

Augmented Reality (AR) and Virtual Reality (VR) in Payment

AR enables customers to virtually try products before purchase, enhancing confidence and reducing return rates. VR creates immersive retail environments, elevating engagement and fostering a sense of presence while making transactions. These technologies streamline the payment process within virtual environments, integrating secure and convenient payment methods seamlessly. As Augmented Reality and Virtual Reality continue to advance, they will redefine e-commerce transactions, offering bridging the gap between online and physical shopping.

Sustainability and Green Payments

It represents the future of e-commerce payments, driven by an increasing emphasis on environmental responsibility. Green payment options prioritize eco-friendly practices, encouraging transactions with reduced carbon footprints, such as digital wallets, carbon offset programs, or renewable energy-powered payment processing. Companies adopting sustainable practices in their payment methods attract environmentally conscious consumers, fostering brand loyalty and positive societal impact. Embracing green payments not only aligns with global sustainability goals but also establishes a competitive edge, shaping a more environmentally conscious future of online commerce.

Internet of Things (IoT) and Wearable Payments

The convergence of the Internet of Things (IoT) and Wearable Payments creating seamless and convenient transactions plays an imperative role in enhancing experiences. IoT devices, interconnected with payment systems, enable automated purchasing based on user behaviour and preferences, simplifying the buying process. By incorporating wearable payment systems into the best online payment gateway in India, merchants can simplify checkout processes, boosting conversion rates. Wearable payment technology, integrated into smartwatches, wristbands, or other accessories, offers quick, contactless transactions transcending traditional boundaries, reshaping the landscape to offer a more connected, frictionless, and user-centric payment ecosystem.

FAQ

- Q1. What trends are shaping the future of e-commerce payments?

The future of e-commerce payments is driven by trends like mobile wallet adoption, increased use of cryptocurrencies, AI-driven fraud detection, and the rise of seamless checkout experiences through technologies like biometrics and one-click payments.

- Q2. How will cryptocurrencies impact e-commerce payments?

Cryptocurrencies have the potential to revolutionize e-commerce payments by offering faster, borderless transactions, reduced fees, and increased security through blockchain technology. As more merchants accept cryptocurrencies, they may become a mainstream payment option for online shopping.

- Q3. What role will AI play in the evolution of e-commerce payments?

AI is poised to enhance e-commerce payments by powering personalized recommendations, fraud detection, and risk management. Machine learning algorithms can analyze vast amounts of data to optimize payment processes, prevent fraud, and provide tailored payment experiences for users.