The FinTech sector has witnessed a remarkable surge in recent years, redefining how we interact with money and financial services. In this era of digital innovation, it is crucial to delve into the ever-evolving landscape of FinTech to grasp the trends shaping its future. Emerging Trends in the FinTech Landscape offers an exploration of the cutting-edge developments that are revolutionising the industry. FinTech sector forward. In the first quarter of 2023, investments in late-stage ventures surged impressively to $977 million, marking a substantial 325% increase from the final quarter of 2022, yet representing a notable 44% decline compared to the same period in 2022. This blog will provide an insightful overview of the transformative forces propelling the growth in the FinTech market.

Here are a few common Fintech trends in 2023. Let us understand these trends deeper and their contribution in revolutionising the Indian economy.

Alternative lending in Fintech

Alternative lending in FinTech has disrupted traditional borrowing models. It encompasses a diverse range of online platforms and innovative approaches that connect borrowers with non-traditional sources of financing. Alternative lending platforms assess creditworthiness beyond traditional metrics, offering individuals and small businesses quicker access to loans. This democratization of finance expands opportunities for those underserved by traditional banks and fosters financial inclusion. Additionally, it provides investors with new avenues for diversifying their portfolios. However, it also raises concerns about risk management and regulatory challenges. In the evolving FinTech landscape, alternative lending redefines the way we access and allocate capital, promoting financial inclusivity and efficiency.

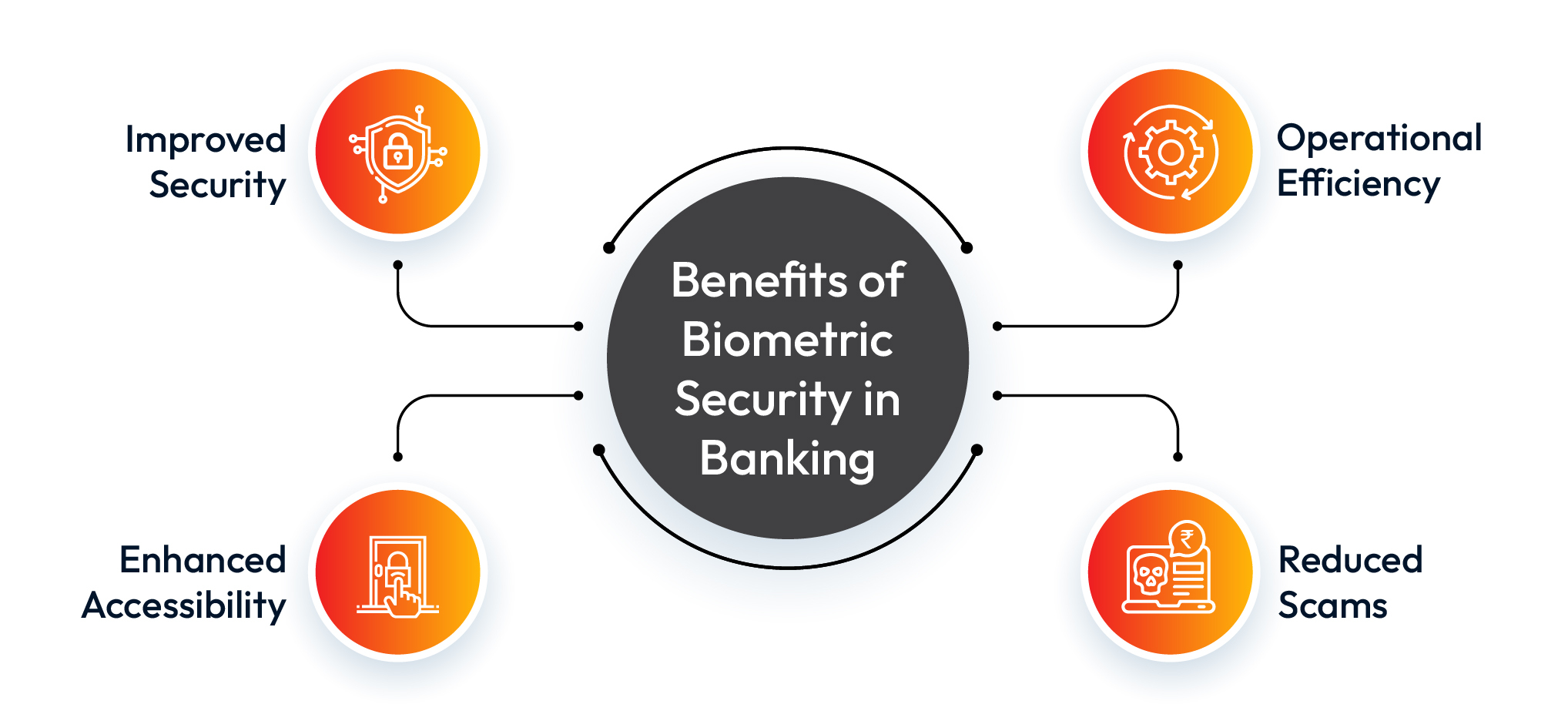

Biometric Authentication in Fintech

Biometric authentication in FinTech is a game-changer in the realm of security and user experience. By leveraging unique physical or behavioural characteristics like fingerprints, facial recognition, or voice patterns, it provides a highly secure and convenient method for verifying identities. This technology enhances protection against fraud, ensuring that only authorized users can access their accounts and perform financial transactions. Simultaneously, it simplifies the user experience by eliminating the need to remember complex passwords or PINs. Biometric authentication not only fortifies the integrity of the payment gateway companies but also paves the way for a seamless, user-friendly, and future-proof FinTech landscape, fostering trust and confidence among users.

Gamification in FinTech

Gamification in FinTech is a game-changer, literally and figuratively. It leverages gaming elements to make financial services more engaging and user-friendly. By incorporating elements like rewards, challenges, and interactive interfaces, it motivates users to actively manage their finances. This not only educates and empowers individuals but also enhances financial literacy and savings. Furthermore, gamification can foster responsible financial behavior, such as budgeting and investment, by making it fun and intuitive. It also promotes customer loyalty and retention by creating an enjoyable, memorable experience. Ultimately, gamification transforms the traditionally complex and intimidating world of finance into an accessible, entertaining, and educational journey for users.

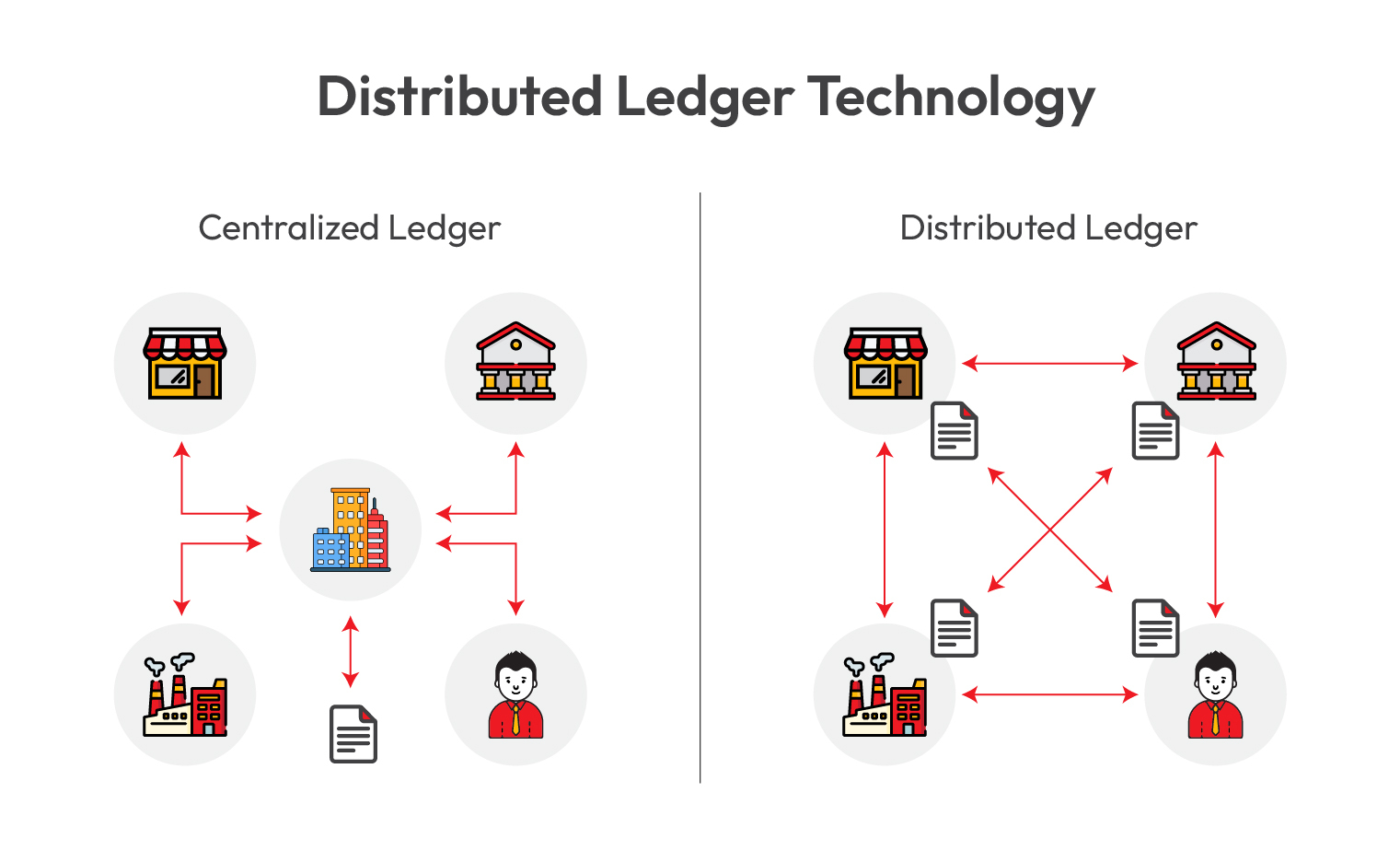

Distributed Ledger Technology (DLT) in FinTech

Distributed Ledger Technology (DLT) being one of the most powerful Fintech trends in 2023 is revolutionizing the FinTech landscape by offering a secure and transparent way to record and verify financial transactions. DLT, often associated with blockchain technology, enables the creation of decentralized, tamper-resistant ledgers where multiple participants maintain identical copies of the transaction history. DLT ensures transactions are encrypted and immutable, reducing the risk of fraud and cyberattacks while allowing for real-time settlement, and reducing the time and cost associated with traditional clearing and settlement processes. Smart Contracts: Smart contracts on DLT platforms automate and enforce agreements, reducing the

Open Banking and API Integration

Open Banking and API Integration are catalysts for the financial industry's evolution. By promoting greater transparency, competition, and innovation they allow secure access to financial data and services. Open Banking fosters customer empowerment, as individuals can easily share their financial information with trusted third parties, leading to tailored financial products and personalized experiences. API Integration enables financial institutions to diversify their offerings by collaborating with fintech companies, enhancing their product portfolios and customer engagement.

AI and ML for financial technologies

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the financial technology landscape. These transformative technologies empower financial institutions to analyse vast volumes of data swiftly, enabling data-driven decision-making, risk assessment, and fraud detection. ML algorithms adapt and learn from data, enhancing predictive analytics for customer behaviour, market trends, and investment strategies. AI-driven chatbots and virtual assistants streamline customer service and interactions, offering personalized experiences.

The landscape of FinTech is continually evolving, and staying abreast with the rise of digital payment trends is imperative in today's financial world. The integration of FinTech into traditional financial services is reshaping the way we invest, transact, and manage our money. Moreover, financial institutions are increasingly embracing technological advancements to enhance customer experiences and streamline operations. As the industry forges ahead, it is clear that collaboration, innovation, and adaptability will be key in harnessing the full potential of these exciting FinTech trends. Pay10 is the best Payment Gateway Provider in India that seamlessly connects businesses and customers, offering swift, secure, and user-friendly payment solutions. With robust encryption and reliability, we ensure your data and money are protected.

FAQ

- Q1.How is AI impacting fraud detection in FinTech?

AI is enhancing fraud detection by analyzing vast datasets and identifying anomalies in real-time, improving the security of financial transactions and reducing the risk of fraudulent activities.

- Q2.How is FinTech addressing financial inclusion?

FinTech is promoting financial inclusion through digital banking, mobile payment solutions, and micro-lending platforms. These technologies are extending financial services to underserved populations, helping to bridge the gap between the banked and unbanked.

- Q3.What are the main cybersecurity challenges in the FinTech industry?

The primary cybersecurity challenges in FinTech include protecting sensitive customer data, securing transactions, and preventing fraud. FinTech companies are investing in advanced encryption, multi-factor authentication, and AI-driven security measures to mitigate these risks.