E-Commerce or Electronic Commerce refers to companies and individuals selling goods or services over the internet. This disruptive technology operates to serve as an online platform for B2B (Business-to-Business), B2C (Business-to-Consumer), C2C (Consumer-to-Consumer), D2C (Direct-to-Consumer) and more forms of emerging e-commerce business models. Although the e-Commerce market had long established its presence, the fact remains Covid-19 pandemic fueled the rapid advancement of e-commerce with increased internet penetration in India.

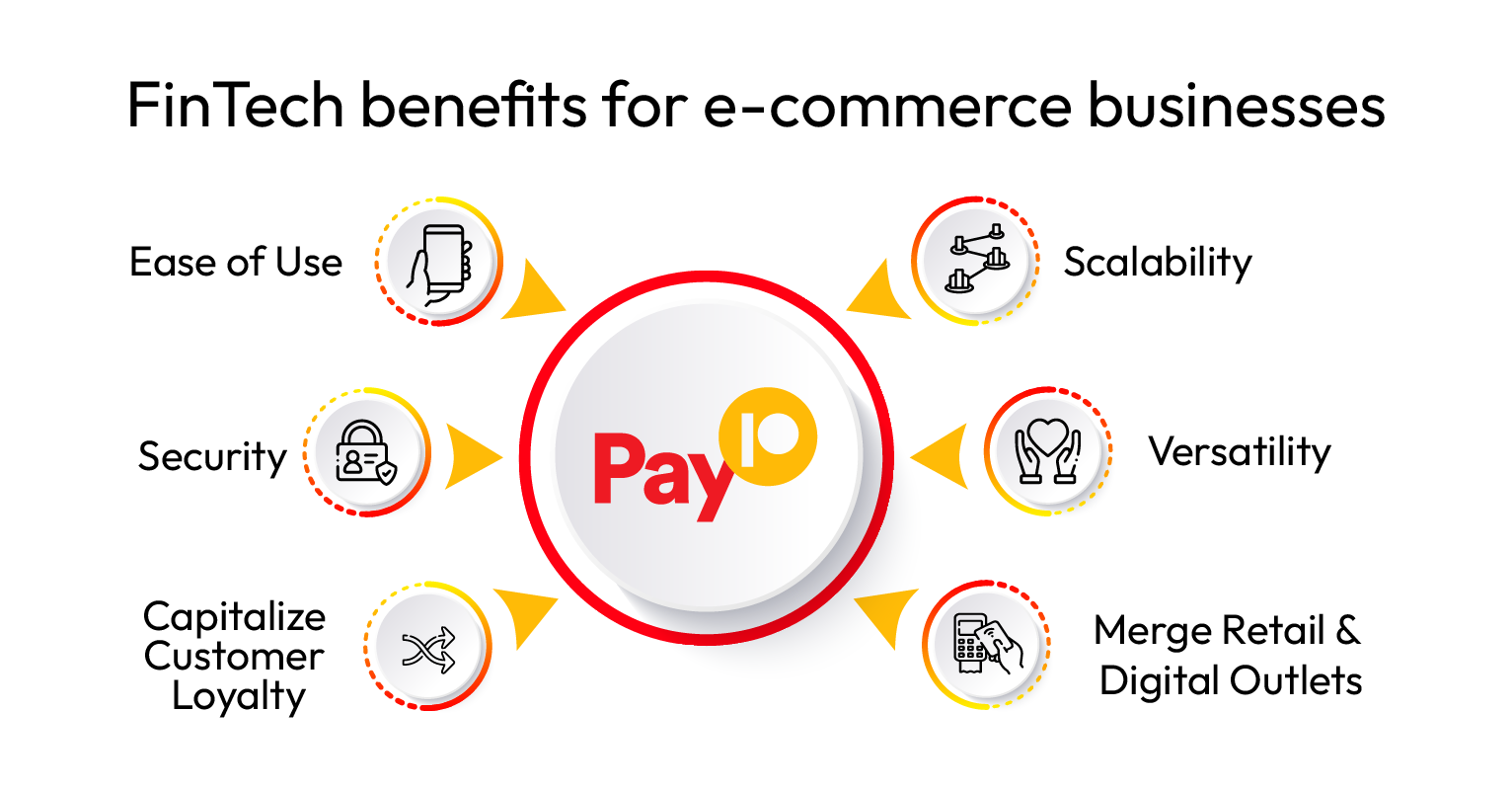

According to a report on ‘eCommerce revenue growth in India from 2018 to 2025’ released by Statista, growth rate of the e-commerce segment in India was charted at 38.5% in 2020. The e-commerce market of India has the potential to surpass the USA to become the second largest online shopper base in the next 1-2 years. FinTech is an inevitable part of the e-commerce business. Here are 6 aspects of development in FinTech sector that contribute immensely to the growth of E-Commerce in India.

- Ease of Use

- Security

- PCI-DSS Certification- Ensures safe storage of card details.

- Easily scalable infrastructure to support your business needs.

- Approved and compliant with RBI (Reserve Bank of India) guidelines

- Strict in-house security guidelines to prioritize the confidentiality of customers’ data.

- Acquire multiple Payment Gateways to reduce transaction failures caused by server downtime during peak business hours.

- Versatility

- Scalability

- Merge Retail & Digital Outlets

E-Commerce businesses operate in a highly competitive marketplace with fast fashion and new innovations in every sector, with brands- local and international, jostling for attention on our smart phone’s screen.

User Friendly UI/UX design helps reduce bounce rate with easy-to-use features and CTA (Call to Action) buttons placed in a clean interface. Easy to use and well-integrated APIs ensure a smooth check-out process for the customer lowering the cart abandonment rate.

According to a report published by Statista, Indians spent over USD 41 billion on online shopping. With the proportionate rise in online fraud, e-tail businesses are expected to have the basic security measures instituted to ensure data security. Certifications such as TSL/SSL are essential when hosting a website.

FinTech integration to collect online payments is a laborious and resource intensive process. Acquire the services of a Payment Gateway with the following security features for a smooth and safe checkout process for both the customer and your business.

The variety and versatility of your products/services listed as an e-commerce business is essential for the fast-changing times. The same logic applies to FinTech services available on your website and application.

Single Payment System with credit/debit cards are outdated, it has become mandatory for e-commerce businesses to accept payments via. Credit/Debit Cards, Internet Banking, Wallets, UPI (Unified Payments Interface), PPIs, QR (Quick Response) Code, EMI (Equated Monthly Instalment), SI, Buy Now Pay Later, etc. Ensure to employ a Payment Gateway that provides all current payment services in the marketplace.

Market access is limited and restrictive for a retail store, whereas e-commerce businesses have boundless access to the marketplace with customers of every demographic with access to the internet.

E-Commerce businesses aided by essential FinTech services are primed to reach a wider audience (Both B2B and B2C) that helps improve the scalability of the business as it opens new markets and opportunities to quickly fuel the growth.

If you have an existing retail outlet and plan to scale the existing operations in the digital realm, it is recommended to streamline the inventory and payment services for better management of the business operation. The new-age FinTech services cater to every modern requirement in the e-commerce sector- from mass payouts to instant payment collection, there is an efficient solution available.

Install cost-effective PoS (Point of Sale) terminal for the retail outlet and a corresponding Payment Gateway to accept digital payments. This unified integration of payment ensures a smooth transaction for the customer that ensures seamless experience for the customer and your business alike.

Pay10 assures to provide FinTech services- Secure Payment Gateway, Payment Links, Re-seller services, e-payment wallets, e-commerce services, online remittance, PoS Terminal, merchant account, and more.