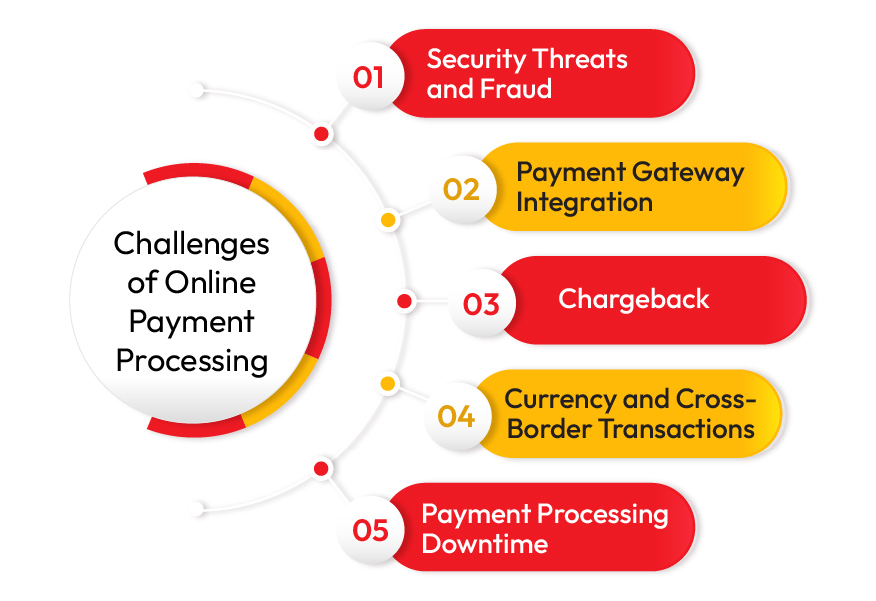

Businesses accept digital transactions in the rapidly evolving digital landscape to survive the modern economy. Undeniably there is a large majority of the population that is familiar with digital transactions, yet it does not take place without any difficulty. From e-commerce platforms to subscription-based services the convenience of digital payments has revolutionised the way we conduct transactions. Digital transactions can encounter various obstacles, including security concerns and technical complexities that can disrupt their smooth functioning. It's important for businesses and individuals to comprehend these challenges to establish a secure and seamless online payment ecosystem. Here are a few common challenges of Online Payment Processing and solutions to tackle them.

Challenge 1

Security Threats and Fraud: In the realm of online payment processing, security is the top priority. With advancements in technology, cybercriminals are constantly developing new tactics to exploit vulnerabilities in payment systems. This can range from phishing attacks to data breaches, which puts businesses at risk of losing sensitive customer information and financial assets. As for consumers, they must be alert and protect their personal data from fraudulent transactions and potential theft.

Solution: Protecting your business and customers from fraud is crucial, and there are many tools that can be used to detect and prevent fraudulent activity during payment processes. It's essential to prioritize fraud prevention to ensure a safe and secure experience for all parties involved. Regular updates should be conducted to ensure that payment platforms are in line with technological advancements and the potential vulnerabilities that may arise from them. There are plenty of the best Payment Gateways in India that are compliant with industry standards and can potentially combat fraud.

Challenge 2

Payment Gateway Integration Integrating payment gateways with different e-commerce platforms and websites can be an arduous yet crucial step. There are chances of incompatibility when it comes to integrating platforms and solving such challenges needs technical expertise and knowledge. For businesses, picking the appropriate payment gateway services in India and guaranteeing its seamless integration is crucial for providing their customers with a user-friendly payment experience.

Solution: Pay10 payment gateway enables easy integration and gives access to multiple modes of payment with top-notch security. We are a fully compliant and backed fully analytical unified dashboard that enables management all your reports & reconciliation with a single click of a button. we have a web and mobile agnostic platformand provide integration for all platforms with APIs'.

Challenge 3

Chargebacks: Chargebacks are a very common issue that arises when a customer disputes a transaction. This challenge in the payment gateway system leads to the reversal of funds from the merchant's account. Chargebacks are meant to protect customers from unauthorised transactions but are often misused harming the financial ecosystem of the business. To handle chargebacks and resolve disputes quickly, efficient customer support and following regulations and policies are necessary.

Solutions: A payment gateway plays a crucial role in the chargeback process by facilitating communication between various parties involved in a transaction and helping to resolve disputes by communicating with the merchant's website to capture payment information. By acting as an intermediary Pay10 payment aggregator facilitates the flow of information between the customer, merchant, acquiring bank, and issuing bank during the chargeback process. It helps to ensure that the process is streamlined, secure, and transparent, ultimately leading to a fair resolution of chargeback disputes.

Challenge 4

Currency and Cross-Border Transactions: The growth of global e-commerce has opened up new avenues for businesses, but it also brings forth challenges related to currency conversions and cross-border transactions. The fluctuating exchange rates and additional transaction fees can have an impact on the final cost for customers, which could potentially affect their purchase decisions. Therefore, handling international payments requires a thorough understanding of regional regulations and compliance requirements.

Solution: Using Global payment platforms, can help with time efficiency and saving money by allowing the cheapest. There are many payment processing agencies in India that automatically enable specific transaction types based on custom rules. Payment gateway should offer multiple modes of payments and with UPI in Foreign countries, travelling and transacting abroad would be easier.

Challenge 5

Payment Processing Downtime: It is essential for online payment systems to be accessible 24/7 as any interruptions could result in lost sales and unhappy customers. Technical issues such as server outages or maintenance problems can disrupt payment processing services, underscoring the importance of having strong backup solutions and contingency plans in place. Thanks to technology, customers now anticipate fast and thorough assistance when it comes to online payments, due to the fact that these transactions entail more complexity and additional risks.

Solution: For a payment interface that is secure, user-friendly, and can handle growth, consider using a payment service provider (PSP) with dependable 24/7 customer support. Businesses must keep a customer-centric approach and focus on assisting their customers during their entire transaction process, especially in case of any issues, to ensure a smooth payment experience with little inconvenience.

The world of online payment processing is a dynamic and ever-evolving landscape, offering numerous benefits and opportunities for businesses and consumers alike. However, it also comes with a set of challenges that require careful consideration and proactive measures. It is important to address security concerns, simplify payment gateway integration, handle chargebacks, comprehend international transactions, and ensure uninterrupted services to create a strong and effective online payment system. Pay10 is an integrated payment gateway that enables seamless online payments to merchants, issuers, and network operators. Incorporating advanced technology, real-time reconciliation, and automated routing, we have created a reputation as a trusted FinTech service provider in India. As an organization, we have advanced our product gamut to bridge the gap and provide easily accessible digital payment solutions to businesses of every scale and size in cities and rural regions alike.

FAQ

- Q1. What is Chargeback?

A chargeback is a financial transaction reversal initiated by a cardholder through their credit card

company or bank. It allows consumers to dispute a charge on their credit or debit card statement

if they believe it is incorrect, unauthorized, or fraudulent.

- Q2. Why should I switch to Pay10 payment gateway?

Being an online business, you must already be using payment gateways. You might be facing

inconvenience with your current product or service. Pay10 is the leading payment gateway

rendering multifaceted online payment solutions with an innovative and ultra-proficient

approach. We are passionate about making digital payments easy, accessible, and secure with

cutting-edge technology aiming to revolutionise the Fintech industry.

- Q3. How does pay10 prevent fraud?

Pay10 is secure with PCI-DSS Level 1, SAR (PAPG & Data localization) and Vendor Site Compliance

Certificate (VSCC), ISO 9001:2015, 27001:2013 certifications. While the servers hosted by reliable

cloud service provider Amazon Web Services (AWS) offer unparalleled data security, Transport

Layer Security (TLS) to encrypt information exchange, CoFT (Card on File Tokenization)

implemented Payment ecosystem with enhanced checkout experience.