In today's digital age, small businesses are finding themselves at the forefront of a transformative shift in the way they handle financial transactions. The advent of online payment solutions has ushered in a new era of convenience, efficiency, and growth opportunities. Let's explore five compelling ways in which online payments are proving to be a game-changer for small businesses.

From streamlining operations and enhancing customer satisfaction to expanding market reach and reducing payment processing costs, the impact of adopting online payments is undeniable. Small business owners and entrepreneurs alike are discovering that, by embracing these digital solutions, they can not only survive but thrive in an increasingly competitive business landscape. The evolution of the Indian economy has risen from physical to digital means over the years. But before we dive into how online payment boosts small businesses, it is important to understand the basics of electronic payments. To begin with, let's understand what digital payments are or what an online payment system.

What is a Digital payment system?

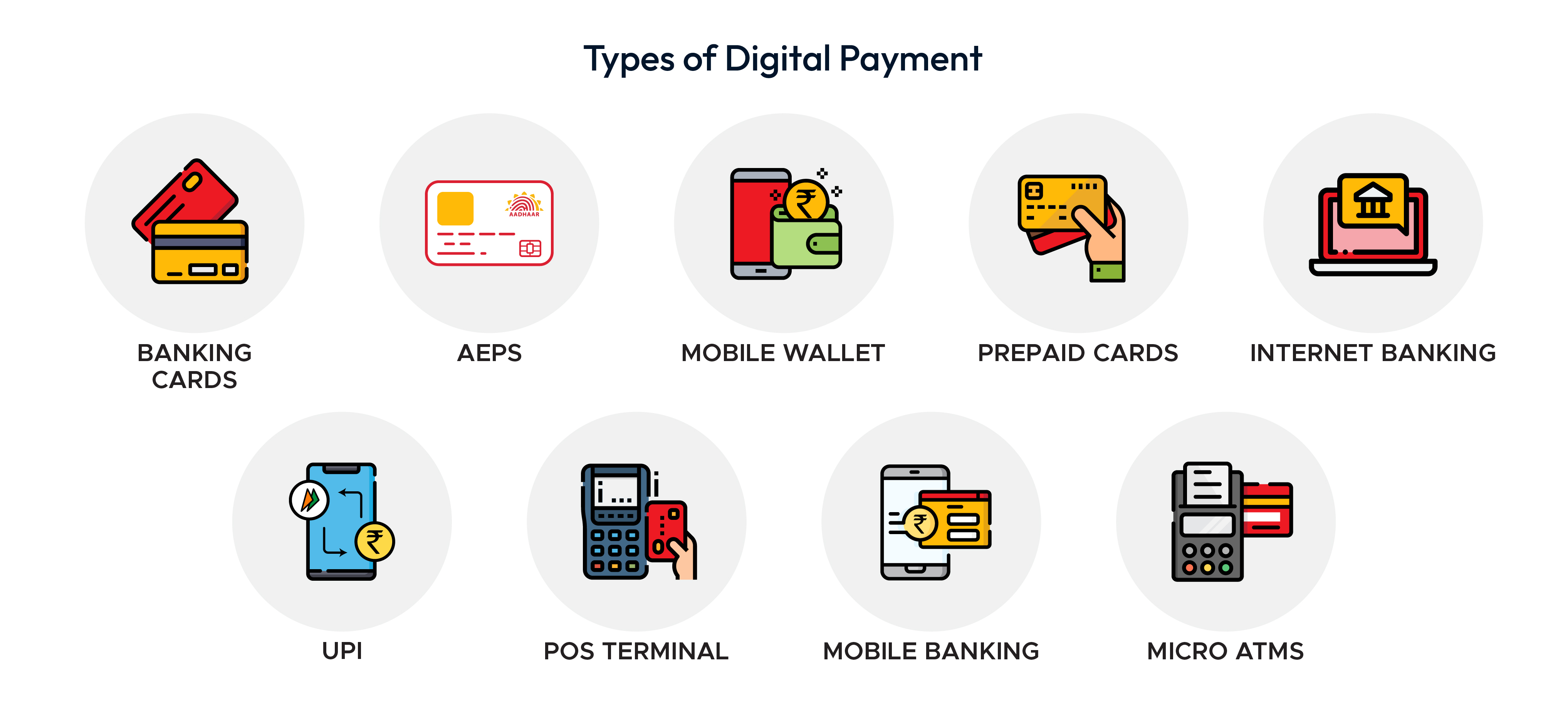

Digital payment systems, also known as digital payment systems or electronic funds transfer (EFT) systems, allow financial transactions to be made using digital technology and electronic devices such as computers, smartphones, and the Internet. These systems make it possible to exchange money or financial assets between parties without the need for physical cash or checks. Digital payment systems are becoming increasingly popular due to their convenience, speed, and efficiency. There are various types of digital payment systems available, and they are used for a wide range of transactions, from buying goods and services online to transferring money between bank accounts.

Reasons to Collect Payment via Online Mode

Collecting payments via online methods offers numerous advantages to businesses and individuals. Firstly, it enhances convenience for customers, enabling them to make payments from anywhere, at any time, using a variety of devices. This accessibility can lead to increased sales and customer satisfaction. Online payment gateways in India , are more secure, with encryption and authentication measures reducing the risk of fraud. Additionally, they streamline financial processes, reducing administrative burdens associated with handling cash or paper checks. Businesses can easily track transactions, automate recurring payments, and access valuable data for financial analysis. Overall, online payment methods are efficient, cost-effective, and integral to modern commerce.

- Online Payment Methods are Convenient and Most Preferred

- Online Payments are More Secure

- Better Customer Experience

- Better Tracking and Analysis

- Increase Customer Base

Top Five Ways Electronic Payment Can Benefit Small Business

Electronic payment methods offer substantial benefits to small businesses. Firstly, they expand a small business's customer reach by accommodating a broader range of payment preferences, from credit and debit cards to mobile wallets and online transfers. This convenience attracts more customers, driving sales growth. Moreover, digital payments reduce the reliance on cash, enhancing security and minimizing the risk of theft or fraud. They also streamline accounting and bookkeeping processes, saving time, and reducing human error. Small businesses can access valuable transaction data for financial insights and target marketing efforts more effectively. Overall, electronic payments boost efficiency, customer satisfaction, and the bottom line for small businesses.

Here are the top five ways electronic payment can benefit small businesses:

Increased Efficiency: In India digital payments, streamline financial transactions, reducing the time and effort required for manual processing. This efficiency allows small businesses to focus on core operations and customer service instead of spending time on administrative tasks.

Faster Cash Flow: Electronic payments, such as credit card transactions and digital wallets, often result in quicker access to funds. This can help small businesses manage their cash flow more effectively, ensuring they have the necessary funds to cover expenses and invest in growth opportunities.

Reduced Costs: Accepting electronic payments can be cost-effective compared to traditional payment methods like checks, which can incur significant processing and handling fees. Additionally, electronic payments can reduce the risk of fraud and late payments.

Improved Customer Convenience: Many consumers prefer electronic payment methods for their convenience. Small businesses that offer a variety of payment options, including credit cards and digital wallets, can attract more customers and enhance their overall shopping experience.

Enhanced Security: Electronic payment methods often come with advanced security features, such as encryption and fraud detection. This can help small businesses protect sensitive customer data and minimize the risk of data breaches or fraud, which can be costly to address.

online payments offer a multitude of benefits that can lead to increased revenue, improved customer satisfaction, and streamlined operations. So, whether you're a budding startup or an established small business, don't hesitate to leverage the convenience and efficiency of online payments to propel your venture to new heights. Your business, and your customers, will thank you for it. If you are in a quest for a versatile payment gateway then, your search ends here. Pay10 is a versatile and reliable payment gateway for Ecommerce websites , that has gained recognition for its seamless and secure online transaction processing. Our innovative platform offers businesses and customers a user-friendly experience, enabling swift and hassle-free payments. With its robust security measures and fraud prevention tools. In a world driven by digital commerce, Pay10 is a valuable ally for businesses seeking to optimize their payment processes.

FAQ

- Q1. Are online payments really secure for small businesses?

Online payments can be very secure for small businesses when using trusted payment gateways and implementing security measures. Pay10 is a reputable payment processor that employs encryption and fraud prevention tools to protect sensitive customer data.

- Q2. Do online payments benefit all types of small businesses equally?

While online payments offer advantages to many small businesses, their impact may vary depending on the industry and business model. The extent of the benefits depends on the specific needs and customer base of each business.

- Q3. What fees are associated with online payments, and how do they impact small business profitability?

Online payment processing typically involves transaction fees, which can vary depending on the payment method and provider. Small businesses should factor these fees into their pricing strategies and assess their individual circumstances while weighing the costs against the benefits to make informed decisions.